A new report from the International Energy Agency released this week shows the world will need a lot more critical minerals to meet demand and ambitious global climate goals.

The report suggests the new supply of critical minerals is absolutely essential for the green energy movement to succeed and ultimately limit dangerous global warming by mid-century.

The inaugural report, Critical Minerals Market Review is aimed at ensuring policymakers and investors are prepared to supply the pipeline of minerals projects required over the next decades.

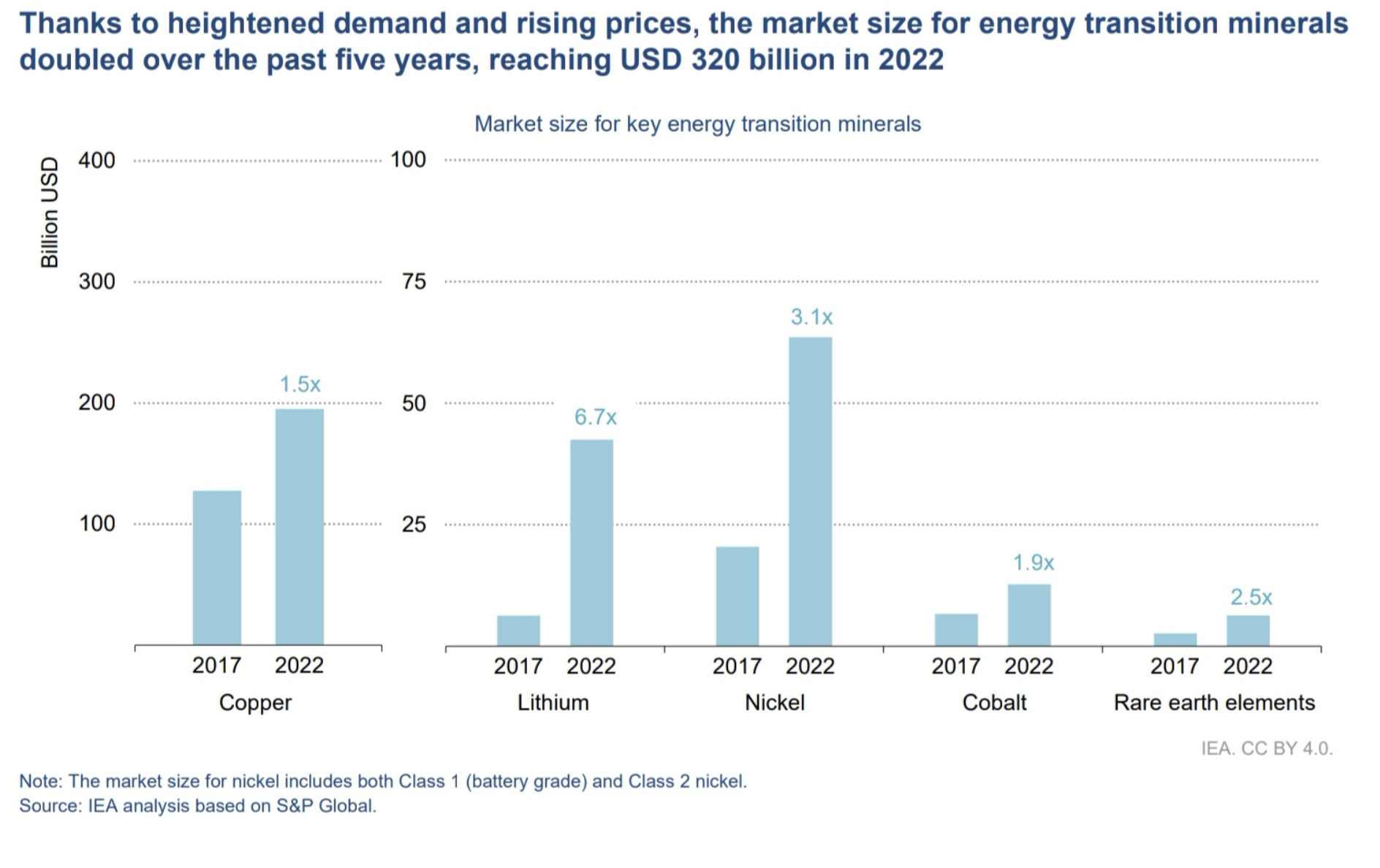

The IEA also quantify the critical minerals market hit US$320 Billion in 2022.

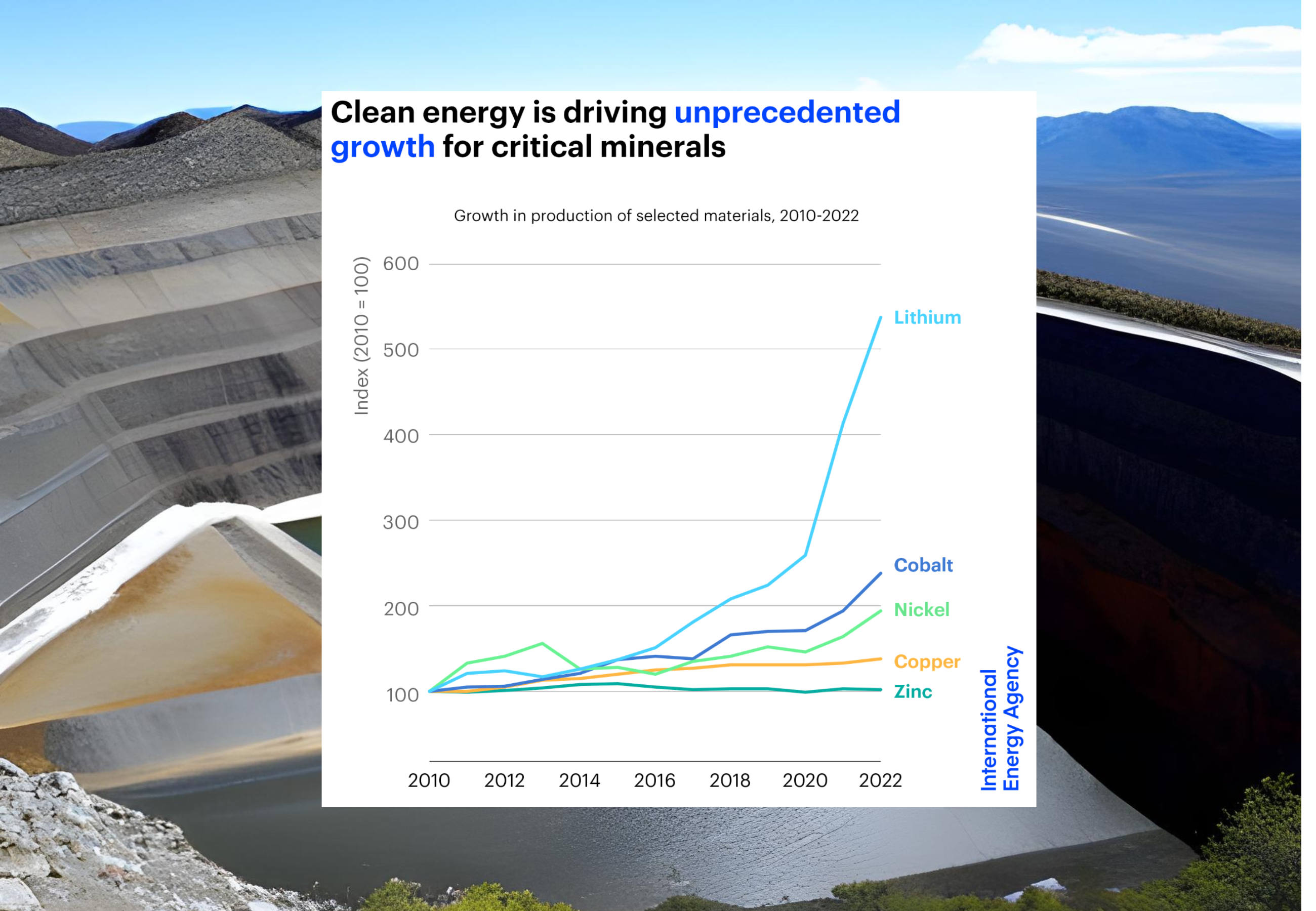

The report confirms green energy sources are driving the uptake of critical minerals, with lithium leading the charge. Cobalt and nickel are also seeing huge surges in demand, driven by the need for batteries for EVs and storage, more copper is needed for new wiring and renewable energy networks.

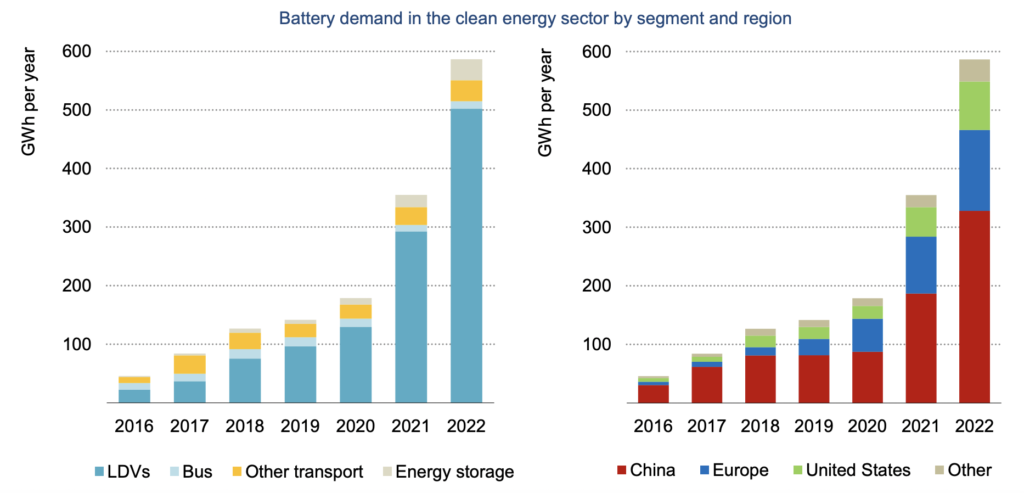

“Global battery demand for clean energy applications increased by two-thirds in 2022, with energy storage becoming a growing part of the total demand. Demand for batteries in vehicles outpaced the growth rate of electric car sales as the average battery size for electric cars continued to rise in nearly every major market,” the report said.

More to be done…

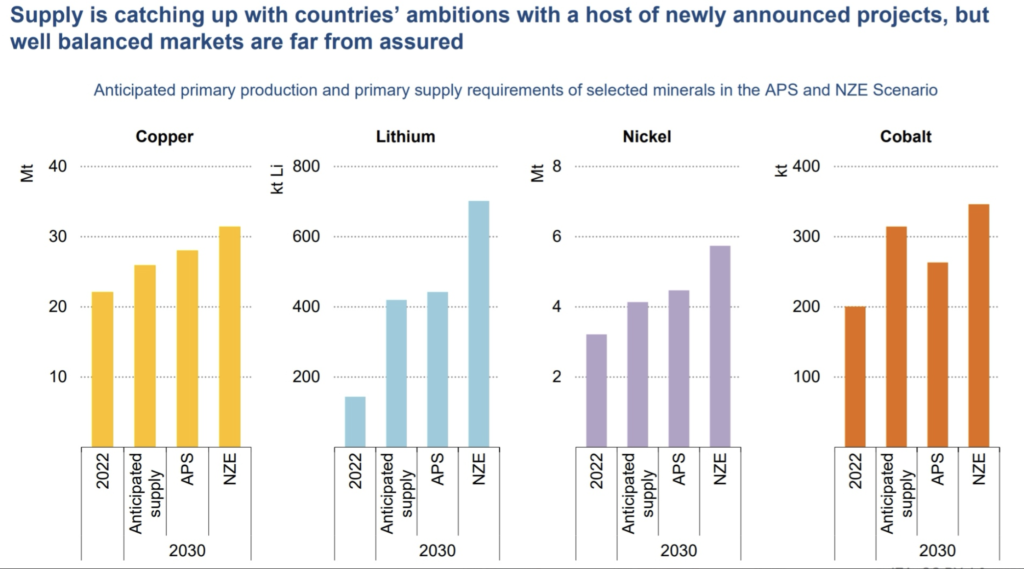

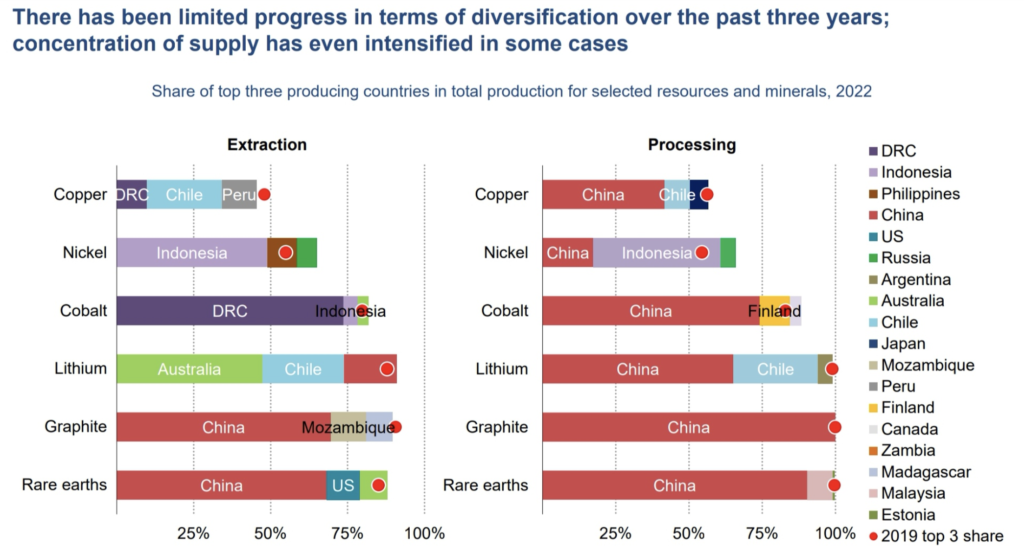

The report also outlines concerns that diversification of supply is yet forthcoming and more needs to be done to keep pace with projected global needs.

“Limited progress has been made in terms of diversifying supply sources in recent years; the situation has even worsened in some cases.

“Compared with the situation three years ago, the share of the top three producers in 2022 either remains unchanged or has increased further, especially for nickel and cobalt.”

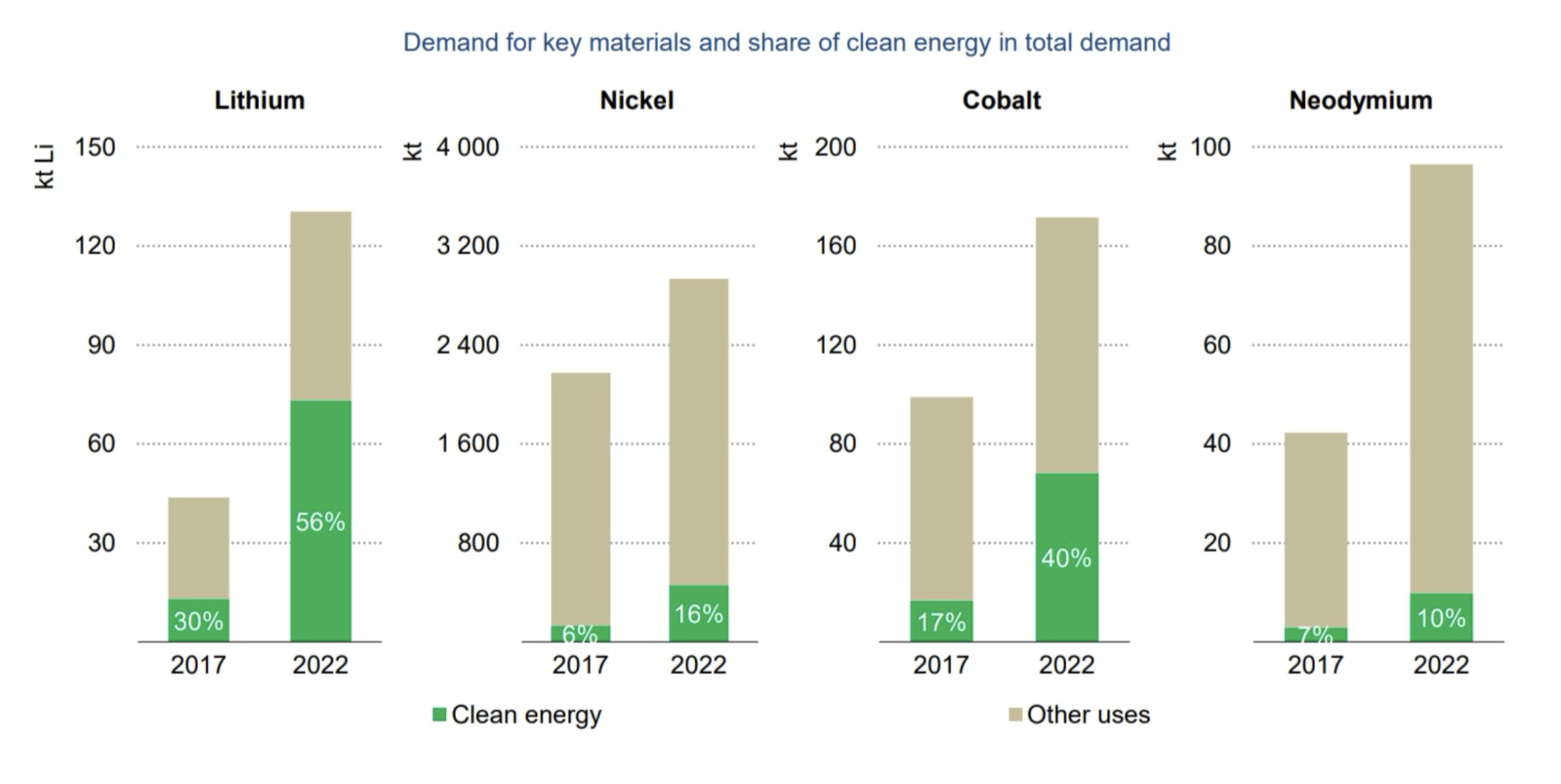

Explosive demand for minerals since 2017 – Lithium, cobalt, nickel, neodymium.

The report also shows the market for critical minerals has doubled since 2017, at around US$320 Billion.

Demand for lithium is up 6.7x since then, nickel is up 3.1x, and rare earths up 2x.

The report also suggests that while supply is on the way, with significant investments being made today, it will be a tight situation for some time and there are no guarantees projects will deliver on time as required.

China continues to dominate the supply chains for many critical minerals, with the West a long way from where it needs to be to ensure demand for green energy infrastructure can be met.

Australia continues to be a hotbed of activity for lithium in particular.

Many nations across the EU, UK, US, Canada and beyond need to hit 2030 climate goals. Those nations will need to step up critical minerals supply initiatives or risk being left behind by China and Russia.

IEA also highlighted the need for a focus on ‘lesser known’ critical minerals, as supply shocks could easily create turbulence in global markets and supply chains.

“While the focus has understandably been on battery metals and copper, recent events such as the export curbs on Chinese gallium and germanium in July 2023 have highlighted the significance of a lesser-known group of critical minerals, often characterised by small volumes, but high levels of supply concentration.”

These illustrate how relatively niche minerals such as magnesium, high-purity manganese, high-purity phosphorus and silicon may disrupt supply chains due to high reliance on a small group of suppliers,” the report said.

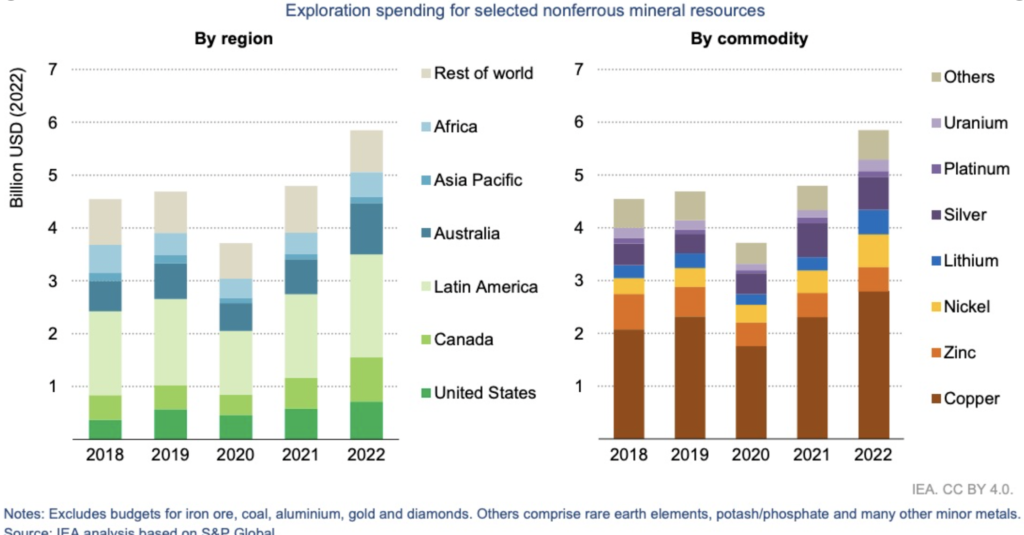

Investment analyst welcomed the report, however warned very little information was forthcoming on beyond 2030, Little mention of exploration, which really needs to take off now to supply demand beyond 2030.

“Little mention of exploration, which really needs to take off now to supply demand beyond 2030. Lithium exploration is doing great progress, with several large discoveries. Not surprisingly as Li deposits still outcrop. Base metals are lagging behind from what we observe,” one analyst wrote.

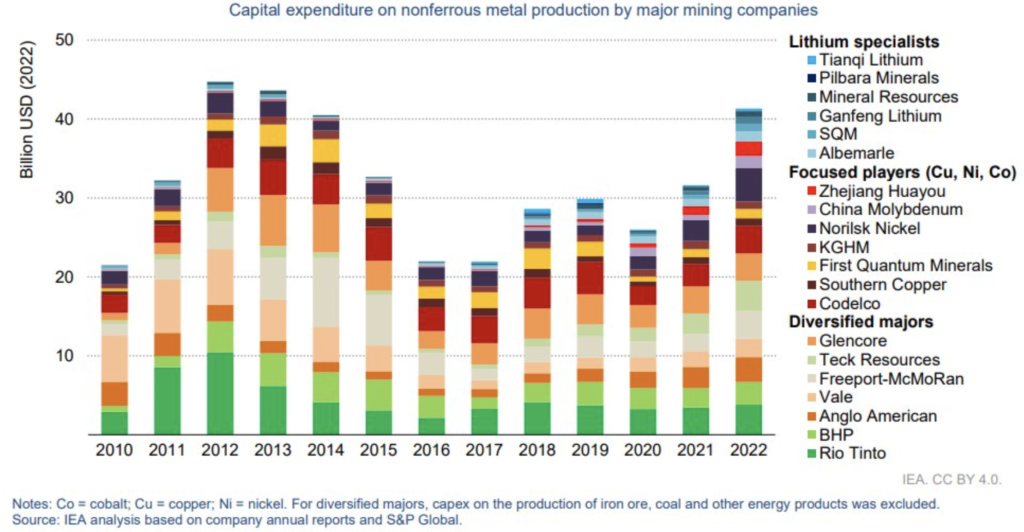

The authors of the report also looked at how mining companies were re-investing in critical minerals projects, via exploration, acquisitions and mergers.

“Strong cash flows in 2021 and 2022 have enabled the mining industry to allocate a greater amount of capital to new developments, exploration, and mergers and acquisitions (M&As)”

“While the remaining surplus has been returned to shareholders and creditors through dividends, share buybacks and debt repayment. Based on the assessment of 20 companies’ cash generation and disposition patterns, approximately 50% of the capital was allocated to investment while around 50% was returned to investors and lenders”

There is significant activity and investment underway across the world in green tech startups.

Around US$1.6 Billion was invested in green tech in 2022.

“In particular, US startups raised most money in battery recycling and lithium extraction, as well as cobalt and magnesium recovery. Canadian and Chinese startups are notably active in battery recycling and lithium refining. European start-ups have been successful at raising money for rare earth elements, battery reuse and battery material supply”

Demand for battery metals was driven mostly by what the IEA calls ‘light duty vehicles’ like cars and vans.

As you would expect, China, the EU and US drove most of the demand by region.

A number of mining companies (most of which didn’t even exist a few years ago) were singled out in the report, as being key to supplying lithium demand in the coming years.

Liontown Resources, Vulcan Energy, Lake Resources, Piedmont Lithium and Lithium Americas were mentioned as new and important players in supply chains.

Despite significant new spending on exploration, not enough critical minerals sources have been found to keep up with expected demand.

The IEA estimates exploration budgets increased to a record US$6 Billion in 2022.

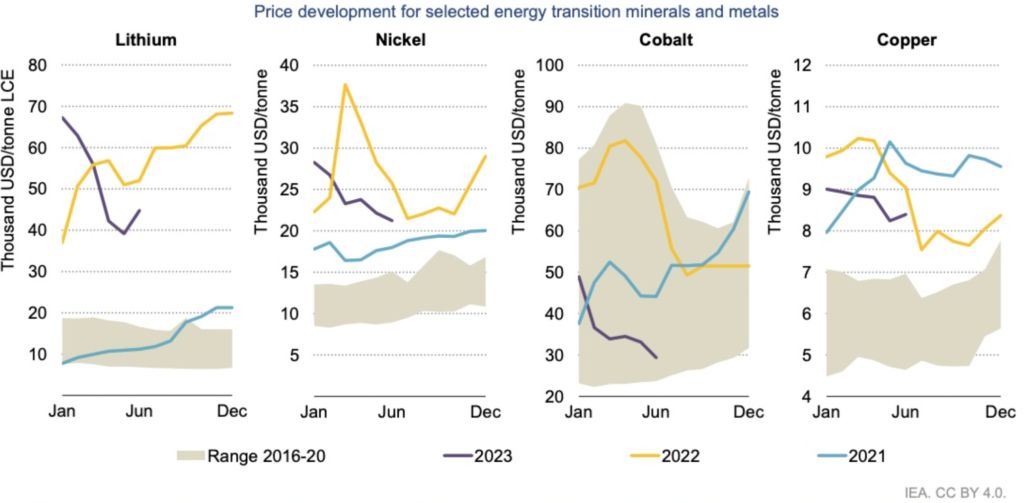

The price of many critical metals “went ballistic in 2021-2022,” said analyst Brandon Beylo in response to the report.

“This year, they’re pulling back hard, and mining stocks are down 50-80%+,” he said.

“However, thanks to energy transition demand, metals prices should stay higher for longer.”

Critical Mineral Mining Investment rose by 30% in 2022.