As China began an economic revolution, requiring unimaginable masses of iron ore for steel infrastructure, a handful of iron ore oligarchs emerged in Australia.

With iron ore mining interests concentrated in the ancient Pilbara region, these entrepreneurs and their investors became some of the world’s richest people.

Today, a handful of those oligarchs – perhaps seeing China’s pivot to a higher-end manufacturing and consumption-driven economy – are eyeing lithium resources as the next source of wealth creation.

Gina Rinehart, one of Australia’s most famous people and richest citizens, has this week confirmed to be behind the extraordinary effort to control the lithium fairytale story in Liontown Resources.

Her private arm Hancock, had been scooping up ASX: LTR shares as the price boomed to $3 per share and American chemical giant Albemarle fought for control through the year.

The $6.6 billion takeover bid took a twist last week when it was revealed the billionaire had invested some $500 million Aussie dollars in the company.

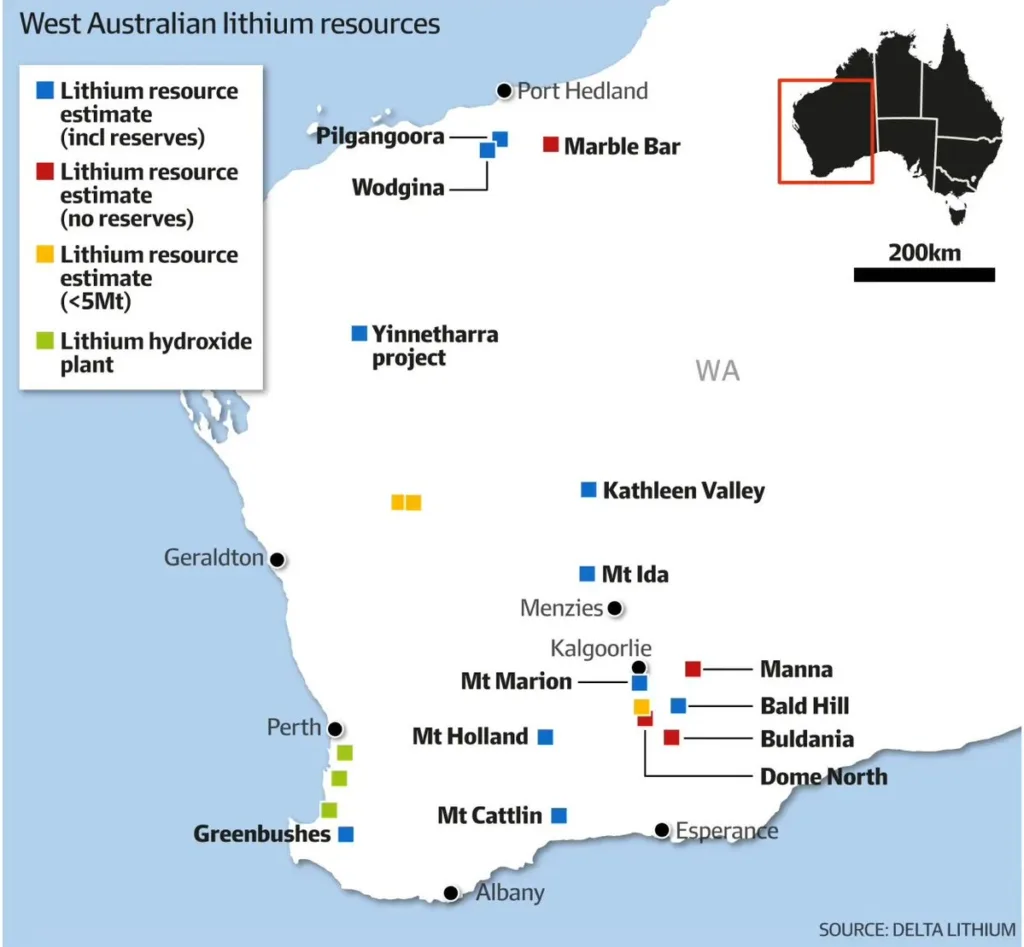

Liontown is developing a massive hard-rock deposit in Kathleen Valley in the middle of Western Australia. The deposit is key to powering the world’s demand for EVs and battery technologies.

Reports said Rinehart is seeking a seat on the board of Liontown, but her strategic intentions are not yet clear.

In recent years, she had also built stakes in other local lithium players, including European-focused Vulcan Resources.

Meanwhile, across town in Western Australia’s Perth, fellow iron ore magnate Chris Ellison was raiding another lithium player. This time Delta Lithium.

Over the last months, Ellisons Mineral Resources (MinRes) had been accumulating shares in Delta before launching a final raid.

MinRes, which already owns significant lithium interests in Western Australia, increased its shareholding in Delta to 17.44 per cent, making it the company’s largest shareholder.

Elison also announced he would join Delta’s board of directors.

“MinRes has been watching the assets at both Mt Ida and Yinnetharra and the Delta team has done a remarkable job in defining and growing them in a short period of time,” he said.

“We think there is significant potential yet to be uncovered and we are excited about what cooperation between our two businesses can yield.”

As that happened, a changing of the guard. Well-known mining entrepreneur David Flanagan stepped down from the role of executive chairman to make way for Mr Ellison.

The activities by two of Australia’s most well-known and powerful mining figures are part of a wider consolidation game happening in the battery metals sector.

Australia contributed some 53% of the global lithium supply per year, with most of the raw lithium exports (96%) going to China for processing and manufacturing.

With China, the EU and the US in a battle for EV supply chains – the country sits in a powerful position as a pivotal player in a net-zero future.

While much of the known lithium reserves are located in Western Australia, new evidence shows other parts of Australia could be home to untapped lithium deposits.

A University of Sydney study suggests deposits exist in Australia’s east coast, including parts of SE Australia and western Queensland.