In recent years, the global nuclear sector has been experiencing a notable resurgence in interest and investment.

The confluence of energy security concerns, climate change mitigation goals, and advancements in nuclear technology have reignited discussions around nuclear power’s potential to play a significant role in the global energy landscape.

These factors have been further amplified amid the backdrop of the Russia/Ukraine conflict, elevated global hydrocarbon prices and increasingly stringent environmental regulations.

An uptick in project developments in numerous markets worldwide since the start of 2023 highlights the growing momentum behind the global nuclear sector.

These include the approval of the construction of six nuclear units in China in August, the announcement of plans to build two reactors in Ukraine in January, the submitted proposals to build four reactors in Turkiye in February, a signed contract for pre-design work on a nuclear power project in Poland, also in February, and finally, the signing of a joint venture agreement to develop nuclear projects in India in May.

According to the World Nuclear Association, there are around 60 reactors under construction worldwide and there is significant further capacity is being created by plant upgrading.

Those countries actively pursuing nuclear development can largely be categorised into three groups. Firstly, those countries that are embarking on new and ambitious nuclear agendas, signalling a departure from their previous energy strategies, including countries like Uganda and Vietnam. A second category of countries is making significant construction and project advancements.

These nations have long recognised the potential of nuclear energy and are actively moving forward with implementing new reactors, modernising existing facilities, and exploring advanced reactor designs to optimise efficiency and safety.

These countries include China, the US, Canada, and Pakistan. Lastly, some countries are reaffirming their interest in nuclear power after undergoing notable government policy shifts. These countries include South Korea, Japan and France.

Industry sentiment improving, sustaining growth over coming decades

Sentiment towards the nuclear industry has been experiencing a notable uptick in tandem with the increasing activity within the global nuclear sector.

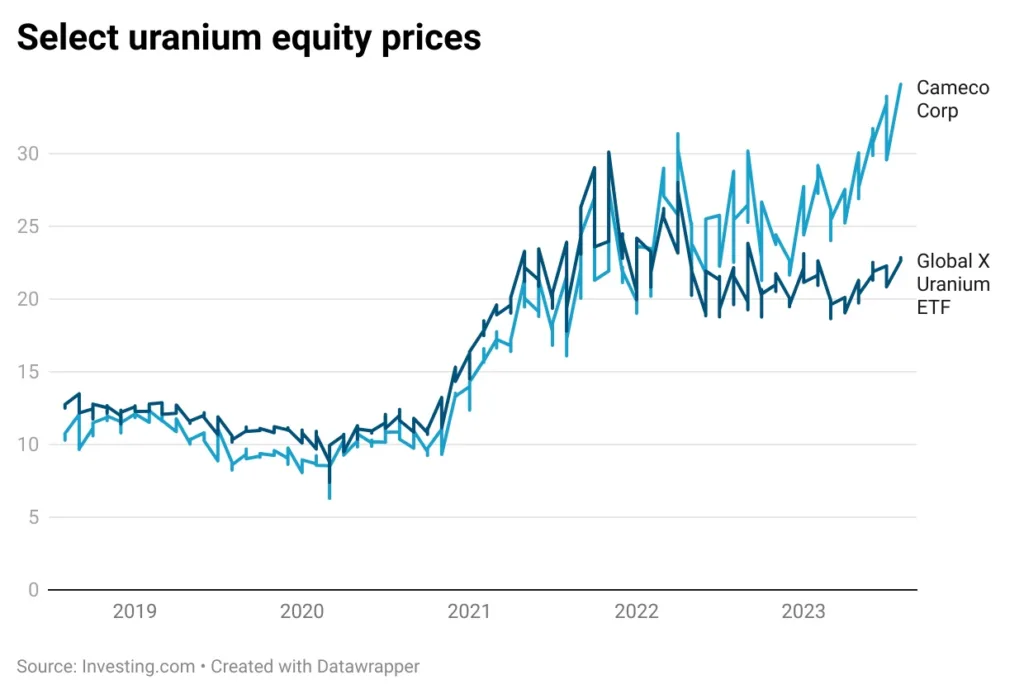

This positive shift can be observed in various indicators, including in the performance of uranium prices and nuclear-related stocks.

The upward trajectory in uranium prices over recent years indicates rising demand for uranium, the critical fuel for nuclear reactors.

Specifically, uranium prices have more than doubled from the beginning of January 2020 to June 2023.

The stock performance of Cameco Corp (one of the largest global providers of uranium fuel) and the Global X Uranium ETF (a broad range of companies involved in uranium mining and the production of nuclear components), is also indicative of the improving sentiment surrounding the nuclear industry.

These positive trajectories signify growing investor confidence in the nuclear industry and its ability to play a key role in the world’s low-carbon energy future.

Source: Investing.com

The gathering momentum behind the industry will drive significant growth in nuclear capacity over the coming decades.

In the 2022 edition of the World Energy Outlook (published by the International Energy Agency – IEA), installed nuclear capacity is forecast to increase by over 43% from 2020 to 2050 (reaching about 590 GWe). The scenario envisages a total generating capacity of 19,792 GWe by 2050, with the new capacity heavily concentrated in Asia, notably in India and China.

This expansion in the global nuclear sector will translate into numerous investment opportunities for stakeholders across the nuclear value chain.

Investors, ranging from technology developers and manufacturers to construction firms, have a unique chance to contribute to expanding and modernising nuclear infrastructure worldwide. Additionally, integrating digitalisation and artificial intelligence in nuclear operations opens avenues for innovative maintenance, monitoring, and optimisation solutions, further enhancing the sector’s attractiveness to investors.

Nuclear power centred in the ‘Energy Trilemma’

Government energy policy typically centres on the priorities of the ‘energy trilemma’: security, decarbonisation, and affordability. Nuclear energy can play a significant role in government energy policies that aim to tackle the energy trilemma given it can offer enhanced energy security, low-carbon power, and potentially cost-effective electricity.

Energy Security

At the heart of energy policy, reflecting a country’s aim for a reliable and resilient energy supply that can withstand disruptions and geopolitical uncertainties. To address this, governments emphasise the diversification of energy sources and supply routes, reducing dependence on volatile fossil fuel markets, and enhancing domestic energy production capabilities.

Nuclear power has the potential to play a pivotal role in enhancing energy security due to its base-load nature and ability to provide a continuous and consistent supply of electricity, unhampered by external factors such as weather conditions or global fuel supply fluctuations.

The stable output of nuclear reactors contributes to grid stability and reduces vulnerability to energy supply disruptions.

Decarbonisation

The second pillar of the energy trilemma, is driven by the urgency to combat climate change and minimise greenhouse gas emissions. As countries strive to meet carbon reduction targets and transition towards a low-carbon energy future, governments want to incorporate low-carbon and carbon-free energy sources into their domestic energy mix.

Nuclear reactors can generate electricity without releasing greenhouse gases into the atmosphere during their operational phase. This inherent characteristic positions nuclear technology as a valuable option for countries committed to reaching their climate goals.

Affordability

The third component of the energy trilemma, acknowledges the economic impact of energy policies on consumers and industries. Governments seek to balance promoting sustainable energy sources and maintaining energy costs at manageable levels for households and businesses.

While the capital-intensive nature of nuclear power can pose financial challenges, advancements in reactor designs and construction techniques are gradually mitigating these concerns. Additionally, the long-term predictability of fuel costs and the absence of carbon pricing contribute to nuclear energy’s competitive advantage over fossil fuels, rendering it an attractive option for governments aiming to ensure energy affordability over the long term.

The long operational lifespan of nuclear reactors, often exceeding 40 years, enables the distribution of the initial investment across a prolonged period, resulting in lower average electricity generation costs over time.

The ‘Energy Trilemma’ increasingly dictating energy policy

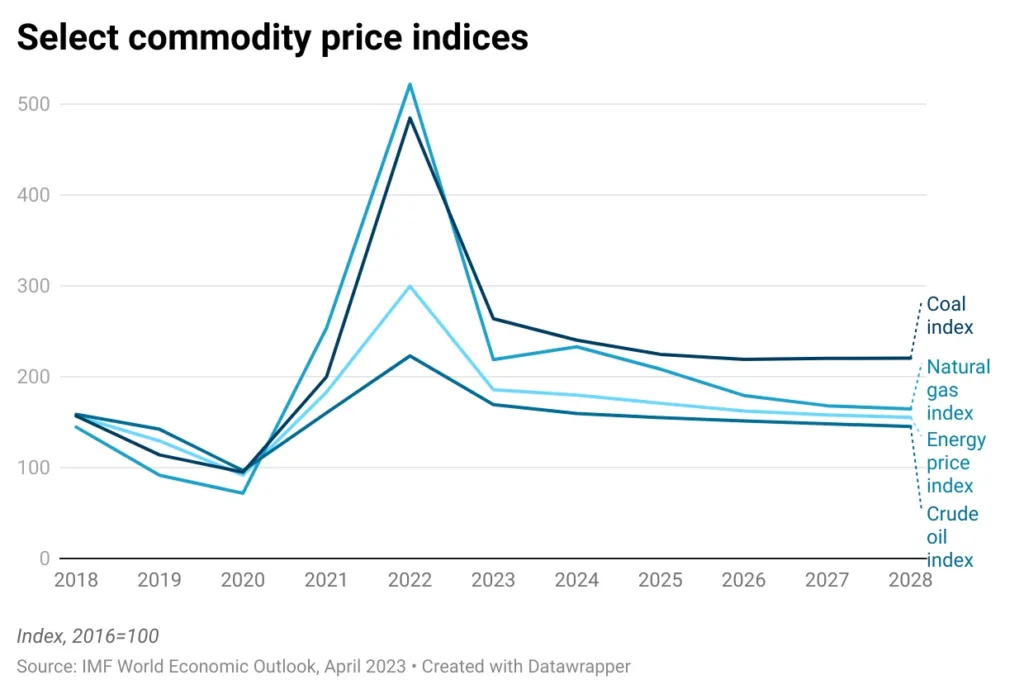

Energy security, affordability and decarbonisation have all risen up the policy agenda for numerous governments in recent years, catalysed by factors such as the Russia/Ukraine conflict, the resultant rise in global hydrocarbon prices and strengthening global commitments to climate change mitigation.

Russia’s invasion of Ukraine, and the associated sanctions placed on Russia, triggered a widespread shift in the global energy sector, resulting in supply and price crises across numerous markets. On average, oil, gas and coal prices increased by 40%, 106% and 142%, respectively, over 2022.

While global oil, gas and coal prices have weakened significantly during the first half of 2023 and are expected to remain subdued over the remainder of the year, energy prices will remain high by historical standards, as the Russia–Ukraine conflict continues to disrupt global commodity flows.

Select Commodity Price Indices (Natural Gas, Coal, Crude Oil)

Source: IMF

Elevated global hydrocarbon prices result in substantial import expenses for numerous countries that continue to depend heavily on thermal sources such as coal, gas, and oil for their domestic electricity production. Consequently, the shift towards reducing the reliance on these unpredictable commodities to meet domestic energy demands is garnering increasing attention from governments.

This strategic diversification aims to alleviate the financial burden associated with import costs.

Another factor that has been increasingly influencing energy policy, and notably the decarbonisation element of it, is rising global commitment to climate change goals. There has been a noticeable increase in awareness and action among countries, organisations, and individuals to address climate change and its impacts.

The Paris Agreement, adopted in 2015, marked a significant milestone in global efforts to combat climate change. Since then, many countries have ratified the agreement and updated their emissions reduction targets (Nationally Determined Contributions or NDCs) to align with more ambitious goals.

The adoption of these commitments signals a collective commitment to curb greenhouse gas emissions and limit global temperature rise. Furthermore, businesses increasingly recognise the importance of sustainability and the need to address their carbon footprints and boost their own ESG credentials. In line with this, many companies have set ambitious goals to reduce their emissions, transition to renewable energy sources, and adopt more sustainable practices.

The Nuclear Renaissance: Country Case Studies

Considering the factors discussed above and recognising nuclear power’s inherent synergy with the overarching policy objectives of affordability, security, and decarbonisation, the technology is rapidly emerging as a favoured energy choice at the global level.

Nuclear developments in several countries provide helpful case studies to support this rhetoric, as outlined below.

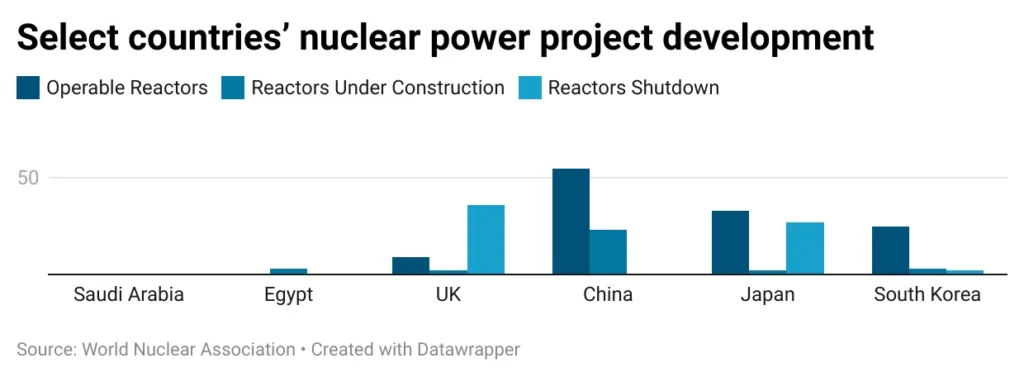

Select countries’ nuclear power project development

Source: World Nuclear Association

The countries listed below exhibit varying degrees of nuclear development and have differing amounts of capacity under construction or in planning (as seen in the chart).

However, all of them have experienced an increase in nuclear activity in recent years.

Security: The need to meet surging electricity demand…

Saudi Arabia

The Kingdom’s pursuit of a domestic nuclear sector holds significant allure as a large-scale, low-carbon power solution. This strategy not only addresses surging electricity demand but also diversifies the energy portfolio. The nation’s persistent high electricity consumption is fuelled by expanding urban areas, energy-intensive desalination, and limited energy efficiency, compounded by electricity subsidies.

This demand coincides with a heavy reliance on hydrocarbons, with gas and oil constituting 60% and 40% of the electricity mix, respectively. By diversifying the energy mix, Saudi Arabia can reserve hydrocarbons for export while capitalising on the current favourable oil price environment.

It was announced in January 2023 by the Energy Minister Prince Abdulaziz bin Salman that “significant quantities” of uranium had been discovered in the Kingdom and the government intend to use it to fuel the development of its nuclear power industry. Also in January 2023, a Saudi-US partnership was agreed to develop low carbon energy. The partnership has identified several potential cooperation fields between the two countries in terms of civil nuclear energy and uranium.

Egypt

Egypt has been considering establishing nuclear power since the 1960s but progress has been slow. That said, recent momentum in Egypt’s nascent nuclear sector provides highlights the government’s keenness to pursue nuclear power amid a backdrop of rising power demand and a costly reliance on thermal imports.

Construction on the El-Dabaa nuclear power plant began in November 2022 and in May 2023, Rosatom started the construction on the third unit at the 4.8GW El-Dabaa nuclear power plant. Construction for the fourth unit is expected to start later in 2023. The power plant is expected to be completed by 2030.

Decarbonisation: nuclear taking centre stage as renewable energy faces hurdles

UK

The UK government’s firm backing of the nuclear industry, evident in its classification of nuclear as ‘environmentally sustainable’, is a pivotal step toward integrating this technology into the core of the country’s Net Zero Strategy. The country has ambitious decarbonisation goals – to reduce greenhouse gas emissions by 78% by 2035, achieve complete emissions reduction by 2050 compared to 1990 levels, and also source 100% of electricity from zero-carbon generation by 2035.

While renewable energy has been a focal point of the decarbonisation agenda, the intermittent nature of solar and wind has introduced hurdles in ensuring a steady electricity supply. Here, it is hoped that nuclear power will step in as a reliable and consistent energy source that can address the gaps created by renewable intermittency.

It was announced in July 2023 that the UK government has invested GBP170.0mn to initiate the construction and procure essential components for the 3.2GW Sizewell C nuclear reactor project. The funding is granted through Great British Nuclear, a company established by the UK Government to oversee nuclear projects. The project is being developed by EDF and is expected to have a lifespan of 60 years.

China

China boasts the world’s largest nuclear programme, and as of 2022, had around 52GW of installed nuclear capacity.

In 2011, the National Energy Administration (NEA) heralded nuclear energy as a cornerstone for China’s power generation over the next “10 to 20 years,” aiming to add up to 300 GWe of nuclear capacity.

This commitment is deeply intertwined with China’s low-carbon vision, which aims to lessen coal reliance and address challenges posed by intermittent renewables.

Ongoing issues such as suboptimal power transfer between regions, underdeveloped renewable pricing mechanisms, and energy storage limitations continue to affect the renewable sector. The introduction of nuclear technology as a stable baseload energy source is poised to counter these hurdles effectively.

In August 2023, the State Council of Mainland China has approved the construction of six nuclear power units, with an Investment of USD16.8bn. Units five and six will be installed at Ningde plant in Fujian Province, units one and two will be installed at the Shidaowan plant in Shandong Province, and unit one and two of the Xudabao plant in Liaoning Province.

Affordability: Nuclear agendas back on the table to reduce costly thermal imports

Japan

Japan has been proactively working on strategies to diversify its electricity mix, aiming to decrease its reliance on imported fuels and traditional thermal power sources. Alongside renewable energy initiatives, the Japanese government has been expressing intentions to expedite the reactivation of nuclear power facilities, particularly in response to the risk of electricity supply shortages due to increased fossil fuel costs over the last year. The country’s nuclear power plants have been inactive but maintain their operational capability since the occurrence of the Fukushima nuclear incident in 2011.

In December 2022, Japan approved a plan to revive nuclear energy, redrafting an energy policy stalled since the 2011 Fukushima crisis to address a severe electricity shortage.

Under a new policy outlined by an advisory panel for the government, the country would “maximise the use of existing nuclear reactors” by accelerating restarts in a reversal of a post-Fukushima plan to phase out the use of nuclear power plants. It would also extend the lifespan of nuclear reactors beyond 60 years and develop advanced reactors to replace decommissioned ones.

South Korea

President Yoon (who won the South Korean election in March 2022) is launching an energy policy u-turn, notably regarding the previous administration’s plans for a nuclear energy phase-out. Surging global energy prices and South Korea’s rising import bill, notably for LNG, have provided a timely and supportive backdrop for Yoon’s policies over the course of 2022.

South Korea’s draft 10th Basic Plan for Power Supply and Demand (BPLE), which will set energy sector goals and development targets applicable to 2036, was published in September 2022. The plan calls for nuclear power capacity to grow from its current 24.7GW in 2022 to 28.9GW in 2030 and 31.7GW in 2036. In addition, President Yoon announced during Abu Dhabi’s sustainability week in January 2023 that South Korea’s efforts to be carbon neutral by 2050 would rely partly on returning to nuclear power.

Key barriers still facing global nuclear.

Despite the potential benefits of nuclear energy, several key barriers continue to challenge its widespread adoption and integration into global energy systems. These barriers encompass a range of technical, economic, political, and social factors that shape the complex landscape surrounding nuclear power. Addressing these barriers will be essential to fully harnessing the potential of nuclear energy.

Public opposition amid safety issues and nuclear waste

Public opposition remains a significant challenge for the progression of nuclear projects globally.

This opposition can stem from various concerns, including safety perceptions, radioactive waste disposal, the risk of accidents, and the potential for nuclear proliferation. One of the main factors contributing to public opposition is the lasting memory of high-profile nuclear accidents, such as Chernobyl and Fukushima.

These incidents have heightened fears about the potentially catastrophic consequences of nuclear accidents and underscored the importance of stringent safety protocols.

Another area of contention is radioactive waste disposal. The long-lived nature of some nuclear waste materials raises concerns about their safe management and storage.

Addressing these worries requires transparent communication about waste management strategies, research into advanced disposal technologies, and implementing secure storage solutions that prioritise environmental protection and public safety.

Threat to nuclear infrastructure a rising concern

The increasing threat to nuclear infrastructure presents a pertinent challenge to the growth of the sector. As the world’s reliance on nuclear power expands, so too do the potential risks posed by both physical and cyber threats.

Physical threats to nuclear infrastructure encompass deliberate attacks aimed at disrupting or damaging critical facilities.

Concerns revolve around the potential infiltration of malicious actors seeking to compromise the safety of nuclear reactors, storage sites, or transportation systems. In tandem with physical threats, the digital age has ushered in a new era of cybersecurity challenges for nuclear infrastructure.

As these facilities increasingly rely on digital systems for monitoring, control, and communication, they become vulnerable to cyberattacks that could disrupt operations, compromise safety measures, or even steal sensitive information.

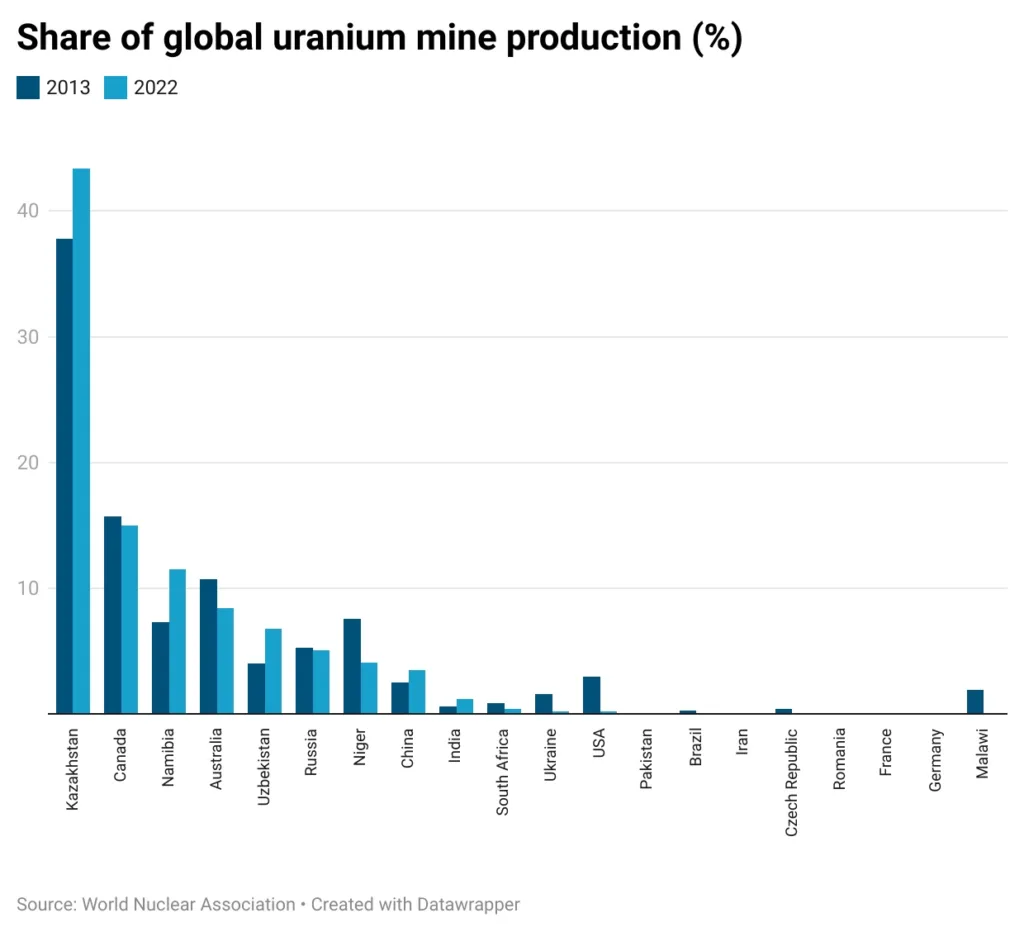

Uranium supply risks

Uranium supply constraints have emerged as a major concern within the context of the expanding global nuclear sector.

The reliance on uranium as the primary fuel for nuclear reactors highlights the critical nature of securing a stable and sufficient supply to support the growth of nuclear power generation.

One of the key challenges lies in the geographical distribution of uranium reserves. While uranium is found in various regions around the world, the concentration of these reserves in a relatively small number of countries can create potential vulnerabilities.

Geopolitical factors, trade disruptions, or shifts in diplomatic relations could impact the reliable access to uranium resources.

This has been most recently evident with the growing pressure facing governments to ban Russian uranium imports amid the ongoing conflict in Ukraine.

Highlighting this, in May 2023, a bill that looks to ban the import of Russian uranium to the US made significant progress by securing approval from a committee in the US House of Representatives.

Furthermore, the military coup witnessed in Niger in July 2023, whereby President Mohamed Bazoum was ousted by the presidential guard, resulting in the establishment of a military junta, further highlights the risks that can be associated with uranium supply.

Niger was the seventh largest producer of uranium globally in 2022, but production and trade will likely be disrupted over the coming year due to the high levels of political uncertainty, security risks and reputational risks facing companies active in the country’s uranium sector.

The Economic Community of West African States (ECOWAS) has already taken action by imposing sanctions on Niger and issuing a warning of potential military intervention if the junta maintains its grip on power.

Inhibitive costs, particularly for developing countries

Nuclear power projects entail significant upfront capital investment and substantial ongoing costs linked to fuel, waste management, and decommissioning.

Additionally, the protracted and intricate construction process of nuclear facilities, which can span numerous years or even decades, starkly contrasts the more rapid and often cost-effective development of renewable energy sources like wind and solar.

The cost of nuclear power is particularly inhibitive for developing countries given that they often face budget constraints and limited access to financing, making it challenging to allocate the substantial funds needed for constructing nuclear facilities.

Furthermore, developing countries may lack the specialised technical expertise and skilled workforce needed to manage complex nuclear projects. This can result in higher costs due to the need to bring in international experts and consultants, adding to the overall expense.

Relying on Russia and China is unpalatable for some

Chinese and Russian firms have gained prominence in the global nuclear competitive landscape by leveraging strong government support, competitive pricing and diplomatic relationships. Both China and Russia have strong government backing for their nuclear industries and state support enables these firms to access substantial funding, which is critical for the capital-intensive nature of nuclear projects. It also helps to reduce costs, allowing their technology to compete on the international stage.

Furthermore, China has been strategic with its technology choice, enabling it to emerge as a global front-runner for reactor construction. Specifically, China chose the 1150MW Hualong One reactor design and established a fixed design and resource framework.

The country has set up a streamlined supply chain and construction approach to easily replicate identical reactors. In contrast, the US Westinghouse AP-1000 reactor has undergone continuous changes due to its unique design, safety adjustments mandated by the NRC, and fluctuating construction plans, which has eroded its cost competitiveness with Chinese technology.

That said, the question of whether governments will want to rely on Russian or Chinese nuclear products raises important considerations that touch on geopolitical, economic, and strategic factors. The increasing prominence of Russian and Chinese nuclear technology and products in the global nuclear sector has sparked discussions about the implications of such reliance for energy security, national interests, and technological sovereignty.

SMR: The future of nuclear power?

Small Modular Reactors (SMRs) have emerged as a promising and innovative avenue that could potentially shape the future of nuclear power. These compact nuclear reactors offer distinct advantages over traditional larger reactors, catering to various applications and addressing some of the challenges that have historically hindered the widespread adoption of nuclear energy.

SMRs are nuclear reactors are significantly smaller than conventional nuclear power plants. They are designed to be modular, with most components built in a factory and transported to the site for assembly.

SMRs offer diverse technology configurations, including pressurised water reactors (PWRs), high-temperature gas-cooled reactors (HTGRs), and advanced designs such as molten salt reactors (MSRs) and integral pressurised water reactors (iPWRs).

Their compact size enhances safety features, simplifies design, and potentially reduces capital costs, while they can also be more flexibly paired with other power generating sources such as renewable energy.

Flexibility and Scalability

SMRs are designed to be deployed in various settings, including remote communities, industrial facilities, and regions with limited grid access. Their smaller size allows for incremental capacity additions, making them adaptable to different energy demands.

Enhanced Safety

The modular design of SMRs incorporates passive safety features, making them less susceptible to large-scale accidents. Inherent safety characteristics and simplified cooling systems contribute to enhanced safety profiles.

Cost Competitiveness

The modular construction and factory fabrication of SMRs offer the potential for cost savings and reduced construction times. Their smaller scale also makes them suitable for investment by a broader range of stakeholders, including smaller utilities and private investors.

Hybrid Energy Systems

SMRs can integrate with other energy sources, such as renewable energy and energy storage, to create hybrid systems that provide continuous, reliable power while accommodating variable renewable generation.

Alongside large-scale nuclear, SMRs have also been gaining traction over recent years, with companies including NuScale Power Corporation, GE Hitachi Nuclear Energy, Holtec, Rosatom, and China National Nuclear Corporation all vying to develop the technology. This competitive landscape underscores the growing recognition of the potential of SMRs to revolutionise the nuclear energy sector.

In fact, most recently in August 2023, the U.S. Nuclear Regulatory Commission (NRC) accepted US company NuScale’s Standard Design Approval (SDA) Application of its SMR for formal review. Prior to that in February 2023, GE Hitachi Nuclear Energy signed a contract to construct the first grid-connected SMR in North America.

The agreement between Ontario Power Generation and two other firms pertains to the development of a 300MW light-water SMR in Ontario, Canada. The reactor will be situated at the Darlington Nuclear Generating Station, which currently hosts 3.5GW of nuclear power capacity.

In conclusion, the pressing need for energy security, coupled with the urgency to address climate change through cleaner energy sources, has rejuvenated discussions surrounding nuclear power’s potential contribution to the global energy mix.

This renewed focus on nuclear technology is further compounded by the current geopolitical climate, as underscored by the Russian invastion of Ukraine, as well as the economic implications of elevated hydrocarbon prices and the growing impetus of stringent environmental regulations.

While challenges remain, advancements in reactor designs, safety protocols, and regulatory frameworks have paved the way for a potential renaissance and significant growth in the global nuclear fleet over the coming decades.

The emergence of SMRs as a promising and innovative solution could be a pivotal development in the global nuclear renaissance.

Their adaptability, versatility, and capacity to overcome historical challenges align well with the renewed interest in nuclear energy, making them a potentially game-changing element in the global nuclear renaissance.

Georgina Hayden

Georgina is a consultant and analyst across global energy, infrastructure and heavy industry sectors.

She is Co-Founder & Director at North Shore Analysis and holds a MA with Distinction from King’s College London in Geopolitics, Territory and Security.

Her particular area of interest lies in the low carbon economy and the risks and opportunities facing companies operating in

an increasingly digitalised, decentralised and decarbonised energy market.