Energy analysts monitoring the uranium market suggested prices may be about to go higher, as supply concerns bite and more nuclear plants come online.

On the supply side, a mix of geopolitical deterioration in uranium-rich Niger, possible Russian sanctions by the US Congress, and a lack of new uranium mine supply could be the perfect storm for the mineral.

The President of UxC, a leading uranium market research firm said the coming days and weeks could see uranium move higher.

“All indications would be that this would be a catalyst for upward moves in the uranium price given the overall tight supply/demand balance in uranium at this time,” Jonathan Hinze told Reuters.

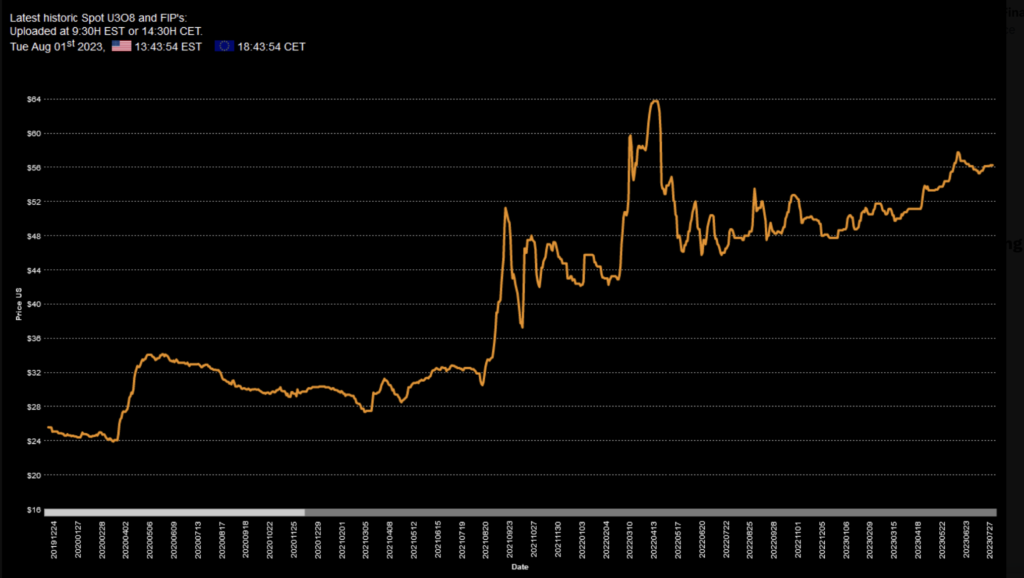

As of writing, the spot price of uranium had crept up to US$56.25 a pound from $56.15 a week earlier according to data quoted by Australian platform Commsec.

The moves were unusual for Summertime in the Northern Hemisphere, as most nuclear fuel brokers were on holiday, analysts said.

On the demand side, the world is seeing a surge in nuclear energy investment, with Japan bringing its fleet back online, European nations (ex Germany) planning to build more or extend the lifespan of plants, along with coming SMR plans and micro-nuclear.

Just this week China announced it would proceed with 6 new nuclear reactors, a new nuclear reactor went online in the US and Japan’s oldest reactor restarted after 12 years offline. Last month Canada started construction on multiple new reactors, a Washington DC-based startup announced billions of dollars in deals for ‘micro-nuclear’ plant technology and the UK announced their ‘Great British Nuclear’ strategy.