Dr Ryan Long

MD of Mining and Metals Research Corporation.

Not since the mid-19th Century has the UK seen such a wealth of mineral exploration and mine development activity.

Back then the British Coalfields stretched from Clyde down to Bristol. Metals like copper, lead and iron ore were extracted in small deposits across the county, while Cornwall was the global epicentre of tin mining.

Today projects in speciality metals like copper, tin and tungsten are being developed alongside precious metals, battery metals and agricultural minerals, demonstrating that the UK remains well endowed with mineral resources.

Mining accounted for just 0.18% of the UK’s gross domestic product in 2022 but this looks set to grow with numerous companies exploring for metals or developing mining operations in Britain. The Energy Transition to a low-carbon economy requires the development of a new large infrastructure system to generate, store and transmit greener sources of energy.

To enable the transition the world will require huge volumes of critical minerals and metals and the UK is no different, but many of these essential metals are both mined, and refined, in countries with complex and unreliable supply chains and as a result, there is very limited supply security.

Tata Group, the owner of Jaguar Land Rover UK has recently confirmed plans to build an electric car battery factory in Somerset.

Tata plans to invest £4 billion to the site creating over 4,000 jobs. This factory will rely on critical metal and mineral imports, of unknown provenance with variable environmental, social, and governance credentials.

The carbon footprint associated with these metals and minerals is also likely to be higher if they have to be transported across vast distances for use in the UK, making it harder for battery makers to produce a net zero end product unless reliable supplies of the critical minerals and metals required for battery manufacture can be developed in the UK.

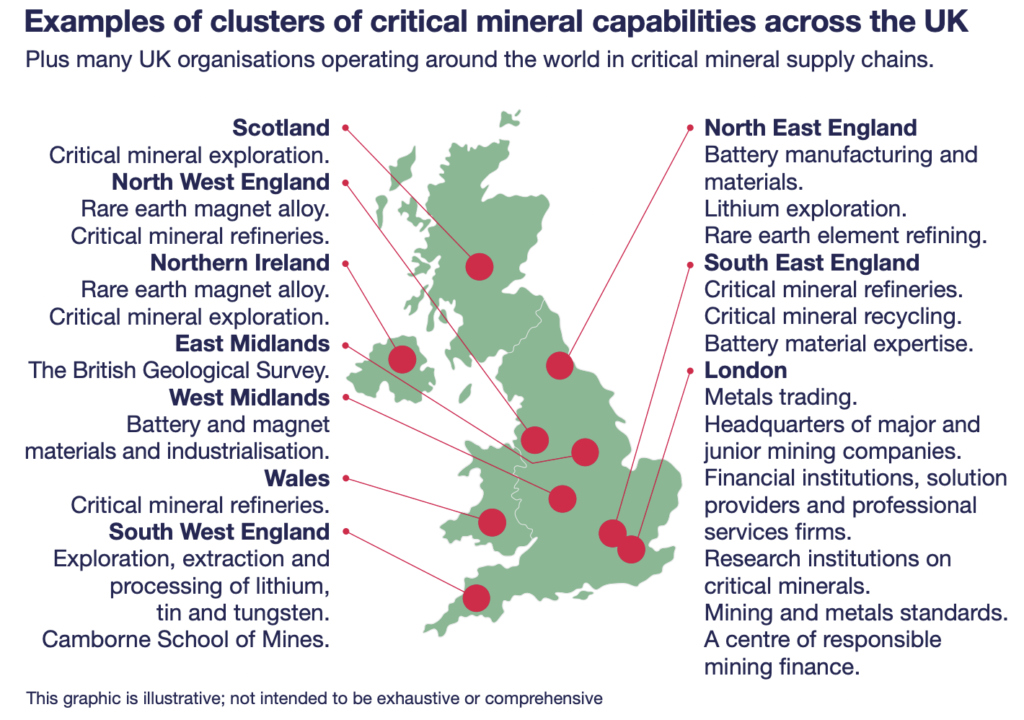

In July 2022 the UK Government published its first-ever Critical Minerals Strategy, setting out its approach to accelerating domestic capabilities, collaborating with international partners, and enhancing international markets.

Alongside this, the UK published its first list of the minerals and metals it considers to be “critical” to the UK’s future.

These “Critical Minerals” are minerals or metals with high economic vulnerability and high global supply risk. Several of these critical minerals can be found in the UK, including lithium, tin, cobalt, and tungsten.

Sitting alongside these exploration and mining companies seeking to develop critical minerals in the UK, is the Critical Minerals Association (UK), a body created to assist in the development of the UK’s critical minerals industry by bringing together change-makers and disruptors. With member companies stretching from exploration-stage businesses, and miners, to companies involved in the final stages of the midstream. They have lawyers, consultants, and financiers too to give a wider understanding of the sector and a range of expertise.

Another important collaboration is the £4.4 million Deep Digital Cornwall Data Hub, which gives small and medium-sized enterprises based in Cornwall and Isles of Scilly access to research skills, knowledge, innovation expertise, new datasets and state-of-the-art immersive technology facilities for 3D and 4D data visualisation. The project team is led by the University of Exeter and Camborne School of Mines, University of Exeter.

There have been many positive developments in the UK critical minerals sector in recent years and future of mining in the UK looks the brightest it has for some time, but should the Government be doing more.

Western mining powerhouse countries like Canada, USA and Australia, have active government incentive schemes designed to encourage and nurture their exploration and mining industries.

As these economies look to move towards net zero, ensuring there are positive incentives for exploring, and developing, the mineral and metal resources required to enable the energy transition away from fossil fuels, will be essential.

Canadian policies could be used a blueprint by the British Government. Canada has a whole range of incentives to encourage exploration both at the corporate and investor level.

The Canadian exploration expenses claims allow business to deduct the costs incurred while determining the existence, location, extent or quality of a mineral resource in Canada and unused balances can be carried forward indefinitely or transferred to investors as flow-through shares.

The Canadian development expenses claims allow business to deduct the costs incurred while sinking or excavating a mine shaft, main haulage way or similar underground work after a mine comes into production, developing a mine before production or buying a Canadian mineral property. Unused balances are carried forward indefinitely or transferred to investors as flow-through shares.

The Canadian flow-through share system allows a business to raise funds for mineral exploration and development in Canada and “flow-through” certain expenses to the share purchaser. These expenses are then considered to have been incurred by the investor, not the corporation, reducing the investor’s taxable income.

Another Canadian incentive is the mineral exploration tax credit, a 15% credit designed to help exploration companies raise equity funds by giving investors a 15% non-refundable federal income tax credit on eligible exploration expenses. The credit can be carried back 3 years and carried forward 20 years.

If the UK Government is serious about accelerating domestic mining capabilities, and reducing its reliance on foreign imports, as part of its Critical Minerals Strategy, it needs to give exploration and mining companies, and those investors who fund them, increased levels of financial support. The Government needs to make exploration and mining in the UK, more attractive than in other countries to incentivise an expansion of the industry.

There is a whole host of highly experienced expat miners and explorers who would welcome the chance to move back to Blighty and work in the domestic mining industry. As a country we have the access to people with the right skill sets and experience, now we just need to establish the industry for them to work in.

Companies that are driving the re-establishment of the UK’s critical minerals/metals industry include:

Pensana (#PRE) is a LSE listed rare earth element development company that is led by the highly experienced team of CEO, Tim George, and Chairman, Paul Atherley.

Pansana’s mining project, the Longonjo Rare Earth Minerals Project is located in Angola and perhaps does not initially seem fit with this article’s focus, however as part of its downstream investment options, Pensana is looking to build a rare earth processing hub in Saltend in the UK.

The Saltend refinery will be the world’s first rare earth processing hub, capable of processing third-party feedstock imported from around the world. During construction of the facility, it will create over 500 jobs with over 125 direct jobs once in production.

The refinery will have the capacity to produce approx. 14,000 tonnes of total rare earth oxides (TREO) per annum, including approx. 4,400 tonnes per annum of Neodymium and Praseodymium (NdPr) once at full production. Nd and Pr are the key metals used in the manufacture of permanent magnets in electric vehicles and offshore wind turbines.

Feedstock for this facility will initially be via Longonjo, one of the world’s largest undeveloped rare earth deposits with an initial 20-year mine life. The operation will initially export approx. 20,000 tonnes per annum of mixed rare earth sulphate, increasing to approx. 40,000t. The mixed rare earth sulphate product produced in Angola is planned to be transported to Saltend for refining.

An economic study for the combined mining, processing, and refining operations at full production, returned a post-tax net present value (8%) of US$3.4 billion and internal rate of return of 60%, using Adamas Intelligence NdPr oxide base case price forecast.

Both the Saltend processing facility and Longonjo Mine are fully permitted. Pensana is currently securing the funds to commence phase 1 development of the Longonjo Mine, with major shareholder Fundo Soberano de Angola (FSDEA) (Angola Sovereign Wealth Fund) to provide an immediate US$15 million loan facility as part of a broader US$80 million investment (subject to due diligence and the finalisation of investment terms) and Absa Group has been mandated to arrange a US$120 million project debt facility.

These combined funding facilities are expected to fund the phase 1 mine development (20,000t per annum), with the company targeting the commencement of main plant construction in early 2024 and commissioning targeted for the end 2025.

Cornish Lithium, a private exploration company, focused on the development of lithium projects located in #Cornwall. The company is led by former mining investment banker, Jeremy Wrathall, who has over 30 years’ experience in the mining finance industry and held senior roles at global investment banks.

Cornish Lithium is focused on two types of lithium projects, geothermal lithium brines and hard rock lithium deposits. Its most advanced project is the Trelavour Lithium Project, located in in an existing china clay pit at Trelavour Down. This project is one of the most advanced lithium projects in Europe and has a JORC 2012 compliant total mineral resource estimate of 51.7 million tonnes at an average grade of 0.24% lithium oxide (Li2O), which is equivalent to 302,700 tonnes of lithium carbonate equivalent (LCE).

A scoping study was completed at the project in 2022, which demonstrated robust economics, retuning a post-tax net present value (8%) of US$318.6 million and internal rate of return of 24.4%, assuming an average lithium hydroxide price of US$20,000 per tonne over a 20-year mine life.

The deposit remains open in open in several directions, and a resource expansion and infill drill programme is underway with 5,000 meters of the 13,000-meter programme completed. The company has commenced some initial workstreams as part of a feasibility study and a demonstration-scale plant is expected to be constructed in 2023.

This demonstration-scale plant is expected to operate continuously providing valuable insights on the processing flow sheet as well as providing product samples for potential customers. Cornish Lithium aims to commence commercial production at the Trelavour Lithium Project in 2026.

Alongside the development of Trelavour, Cornish Lithium is also developing a series of six geothermal lithium brine projects, located across Cornwall, with agreements covering 600km2 onshore and 400km2 offshore.

Work completed to date demonstrated the proof of concept with two c.1,000-meter-deep research boreholes drilled at United Downs, proving the permeability, and indicating commercial lithium concentrations with minimal levels of deleterious elements.

Cornish Lithium has also completed drilling down to a depth of 2,000 meters at a second site, Twelveheads, encountering four permeable zones, each containing geothermal water and with an average lithium content of c.100 ppm lithium at the final target depth.

The temperature at the end of the borehole was 72°C and Cornish Lithium believes that this carbon-free heat could be used by local businesses such as dairies, breweries, agricultural greenhouses, and regional heating schemes, generating additional revenue for the Company.

As a result of encouraging work from its previous three boreholes, the Company is now progressing its fourth exploration borehole at Blackwater. Drilling commenced at the start of April with drilling and testing operations expected to take approximately six months. Drilling additional wells at other sites is likely to continue after the completion of the Blackwater wells.

A pilot plant for the extraction of lithium from the geothermal waters is expected to be constructed before the end of the year, and is successful would be followed by the construction of a demonstration-scale plant at one of the well sites.

Imerys British Lithium Limited and Imerys

British Lithium is a private UK company operating a joint venture with Imerys, a world leader in mineral-based specialty solutions. The CEO of British Lithium is Andrew Smith a mining engineer who has worked in the mining industry for 14 years and has led four successful feasibility studies.

Imerys British Lithium, the joint venture company, is advancing the British Lithium Project located in Roche, Cornwall, which has a JORC 2012 compliant inferred mineral resource estimate of 160.8 million tonnes at a grade of 0.54 % lithium oxide. This resource base gives the partners sufficient confidence to target a life of mine exceeding 30 years at a production rate of 20,000 tonnes of lithium carbonate equivalent per year.

During 2021, British Lithium successfully designed, built, and commissioned the world’s first end-to-end lithium pilot plant treating the lithium mica granites, beneficiating the mica and producing high-purity, battery-grade lithium carbonate. The pilot plant continued to operate throughout 2022 and continues to be an important testbed as the partners optimise and refine the full-scale plants design.

The partners have commenced an extensive drilling programme to expand and enhance the resource base, which will be used in the fully-funded pre-feasibility study, which is also currently underway. The partners are targeting being in full-scale production by 2028, employing 350 staff directly, plus many more indirectly via its supply chain.

Aberdeen Minerals is a privately owned mineral exploration company currently engaged in battery raw material mineral exploration in Northeast #Scotland. The company is led by CEO, Fraser Gardiner, a Scotland-based geologist who has worked around the world on discovery, exploration, and mine development projects.

Aberdeen Minerals has built up a 74km2 land package in Aberdeenshire, Northeast Scotland, over the past 5 years by securing agreements with local land owners, who own the mineral rights. This gives the company a first mover advantage in an area that’s geological potential has been proven by historic exploration.

Conducted in the 1970’s, drilling completed by companies including mining major Rio Tinto, established the presence of the largest known #nickel deposit (17 million tonnes) in the UK at the Arthrath Deposit.

Aberdeen Minerals has recently completed the first ever large-scale heliborne airborne geophysical survey in Scotland defining a 7km long dyke like conduit, with 6 high-conductivity anomalies within 5 km of the Arthrath Copper-Nickel Deposit and an additional 15 high-conductivity regional anomalies within 20km.

Aberdeen Minerals’ maiden drill programme, 1,715 meters over seven holes, not only validated the historic drilling confirming the presence of significant nickel-copper mineralisation, but also demonstrated the increase in both mineralisation grade and width at depth, as well as proving that mineralisation continues to a depth of 100 meters below previous drilling and remains open.

The company’s geological model for the project, theorises that there may be a larger higher-grade body of nickel-copper mineralisation at depth associated with the change in orientation of the dyke like conduit, which is similar to the model of other large magmatic nickel sulphide deposits in the world.

Aberdeen Minerals has commenced the preparation of an Exploration Target for the immediate area around the Arthrath Deposit and anticipates publishing the results before the end of the year. Alongside this, the company will be completing ground-based EM geophysics to refine the local and more regional targets ahead of drilling. A follow up drill programme is targeted for the first quarter of 2024.

Cornish Metals is and AIM and TSX-V listed exploration and development company advancing the historic South Crofty Tin Mine, located in Cornwall. The company is led by CEO Richard Williams a professional geologist with over 30 years of experience in the mining and mineral exploration sector.

The South Crofty Tin Project is a high-grade underground tin deposit with a JORC 2012 compliant total mineral resource estimate of 4 million tonnes at an average grade of 1.63% tin.

A preliminary economic assessment (PEA) was completed at the project in 2017, which retuning a post-tax net present value (5%) of US$130.5 million and internal rate of return of 23.4%, assuming an average tin price of US$22,000 per tonne over an 8-year mine life. The company is currently working on a number of initiatives that could further improve these metrics.

The first is the use of optical ore sorting, which has been proven to add significant value at a number of existing tin mines, including San Rafael, the largest underground tin mine in the world. An optical ore sorter could potentially reduce the plant input by 20-40%, which would mean the plant could be smaller and therefore have a lower capital and operating costs. The company expect to receive the results from the ore sorting amenability work along with that of metallurgical studies and paste backfill studies by the end of Q3 2023.

The second initiative, is the potential to increase the life of the mine or increase the production rate by adding additional ore. Earlier in the year Cornish Metals made an exciting discovery on at the Wide Formation, which is inferred to lie parallel to and beneath the Great Flat Lode.

The Wide Formation was originally interpreted to exist from exploration drilling conducted in the 1960s but has it never been followed up a target. The Great Flat Lode was mined historically over a five-kilometre strike length and from depths ranging from surface to 680 metres below the surface. If the Wide Formation is a parallel structure, it has significant potential to be a very large target. A follow-up drill programme on this target is expected to commence shortly.

While these developments are being advanced, Cornish Metals remains focused on preparing to dewater the old mine at a rate of 25,000m3 per day. The company is coming into the final stage of constructing the water treatment plant and is anticipated commencing pumping by September 2023. It is expected to take 18 months to fully dewater the mine.

With pumping operations about to commence Cornish Metals has around 50 employees on site with an additional 20-30 contractors in place, once in production it is estimated that the project could generate 250 – 300 direct jobs.

Looking ahead, further digitisation of historic assay information and data from the metallurgical drilling programme is being incorporated into an updated Mineral Resource Estimate and this is expected to be announced at the end of September 2023. A feasibility study for South Crofty Tin Mine is targeted for completion by the end of 2024.

Weardale Lithium is a private UK company focused on the exploration and sustainable production of lithium from underground geothermal brines in #Weardale, County Durham. Stewart Dickson is the CEO of Weardale Lithium and a former investment banker he has extensive experience leading and advising natural resources companies at the Board level.

Between 2004 and 2007 a consortium led by the Newcastle University completed two boreholes at the project. These holes demonstrated the presence of high levels of lithium in the underground brines. Since becoming involved in the project, Weardale Lithium has used these boreholes to produce lithium carbonate from the brines for the first time in the North of England.

This milestone enables Weardale Lithium to advance its plans for scaling up lithium extraction trials. It also supports the company’s investment decision for the construction, and operation, of a direct lithium extraction (DLE) pilot plant for test-scale production of lithium over the next 18 months.

The modular pilot facility will be located on the brownfield, former cement works at #Eastgate, which has significant infrastructure already in place. Weardale Lithium is targeting commercial production of approximately 10,000 tonnes of lithium carbonate per year, which has the potential to directly generate around 125 new full-time, highly skilled jobs.

At commercial scale, Weardale Lithium estimate that the project could generate £1bn of gross economic value for the North East region and supply 15% of forecast UK lithium demand by 2030 (based on Advanced Propulsion Centre UK estimates).

Tungsten West is an AIM listed mining company operating the Hemerdon Tungsten-Tin Mine, located in South #Devon. Led by CEO, Neil Gawthorpe, a mining engineer with extensive operational experience on numerous global mining operations.

Hemerdon is the second largest deposit of tungsten in the world, with a total JORC 2012 compliant mineral resource estimate of 351.5 million tonnes at a grade of 0.13% tungsten equivalent.

Tungsten West acquired the project in December 2019 for £10 million, after the previous operator had invested over £200 million into the project.

As part of the company’s re-activation of operations at Hemerdon, an updated feasibility study was published in January 2023, this returned a post-tax net present value (5%) of £297 million (base case) with an internal rate of return of 25%, assuming a starting tungsten price (APT) of US$340 per tonne with a 3% annual price increase.

Over the 27-year mine life Hemerdon is expected to produce an average 2,900 tonnes of tungsten trioxide in concentrate and 310 tonnes of tin in concentrate, positioning Tungsten West as the largest tungsten producer in the western world.

As part of the mine re-activation Tungsten West has processed legacy tungsten pre-concentrate and tin concentrate, as well as a limited amount of residual material remaining in circuit since the historical closure of the previous operation, totalling just over 50 tonnes. This initial production is expected to generate £400,000 in revenue. This exercise also provided valuable insight into the future operating parameters for the beneficiation process.

Preparations for the full-scale project re-activation is ongoing and Tungsten West continues to work closely with the Environment Agency and Devon County Council, to secure the final permits for the operation before the end of the year.

Once in place, Tungsten West will be able to access its development funding facilities and commence the required civil construction work, installation of the XRT ore sorters, crushers etc.

Commissioning is targeted for H1 2024 with full scale production to commence in H2 2024.

Cornwall Resources Limited and Strategic Minerals Plc

Cornwall Resources is a subsidiary of AIM listed Strategic Minerals. Cornwall Resources is led by managing director, John Peters, who has over 30 years corporate finance experience at senior levels, whose expertise crosses a number of industries including natural resources.

Cornwall Resources is developing the historic Redmoor Tungsten-Tin Project, located in northeastern Cornwall. The original Redmoor Mine was first operated in the 18th century. Redmoor has a JORC 2012 compliant inferred mineral resource estimate of 11.7 million tonnes at a grade of 1.17 % tin equivalent, the largest defined metal resource in Cornwall.

In addition, there is further potential to increase the size of the resource base as it remains open at depth over much of its length and is open to the west. An Exploration Target has been defined for the project for an additional of 4 to 8 million tonnes.

Strategic Minerals completed a scoping study at the project in 2020. This study returned a post-tax net present value (8%) of US$128 million and post-tax internal rate of return of 28.6%, over a 10-years mine life using a tin price of US$22,000 per tonne and a tungsten price (APT) of US$330 per tonne.

The company recently submitted a grant application to the local councils, which was not supported but has been encouraging by the council to submit a modified application in August.

In addition, the company plans to re-log and assay sections of the core that came from the last drill programme as it believes there is significant potential for additional mineralisation, which was observed in the cores at higher levels above the sheeted vein system that hosts the current resource base.

Cornwall Resources is in active discussions with various parties concerning potential collaborations to advance the Redmoor Project and is currently working on creating and executing formal development arrangements. Additionally, there are, currently, multiple groups accessing the Redmoor data room confidentially.

Cornish Tin is a private exploration company focused on advancing the Great Wheal Vor group of 26 former producing tin and copper mines in the Mining District of Breage, Cornwall, UK. Underground mining first started at the Great Wheal Vor Mine in the 15th century and continued until 1715, during which time the mine was well known for its high-grade tin mineralisation.

Cornish Tin is led by CEO, Sally Norcross-Webb, a corporate finance lawyer and a mining, exploration and mineral rights specialist in various jurisdictions globally including the UK.

Cornish Tin has collected an extensive data set and is compiling and digitising all the historic information for the Great Wheal Vor group. Initial compilation work culminated in the definition of a number of tin and lithium exploration targets within the project area.

The company commenced an initial Phase 1 drilling programme in 2022, consisting of 22 holes covering 6,500 meters of diamond drilling. The Phase 1 programme discovered several new tin lodes in multiple locations with grades of up to 6.28%.

The drill programme also discovered significant lithium mineralisation, which is exciting as this area has never been explored for lithium.

Cornish Tin is currently reviewing the drilling results and continuing its historic data compilation exercise, while also implementing additional geochemical studies. This work will feed into further refinement of its targets ahead of a follow-up drill programme in H1 2024.

Conclusion

The UK mining industry is experiencing a resurgence, driven by the need for critical minerals essential for building a sustainable future. With an array of exploration projects and mining operations focused on metals like lithium, tungsten, tin, and rare earth minerals, the industry is poised to play a vital role in the country’s economic growth and job creation.

With increased governmental focus and additional financial incentives designed to increase domestic capabilities perhaps as part of its new Critical Minerals Strategy, the UK Government can re-invigorate its mining industry, reducing dependence on foreign suppliers and ensuring a secure supply chain.

The UK mining and exploration industry would not only be contributing to the national economy but also building a better and more sustainable Britain for the future.

Dr Ryan D. Long is the MD of Mining and Metals Research Corporation.

He publishes regular insight on the Global Mining Industry, with a focus on gold, base metals and battery metals. He has a PhD in Economic Geology from James Cook University, an MSc in Mining Geology from Camborne School of Mines and a BSc Hons in Exploration & Resources Geology from Cardiff University.

Follow Dr Long: