Central Asia, a region often ignored in global geopolitics, is suddenly a hub of diplomatic activity and for good reason – there may not be enough uranium supply to meet competing global demand.

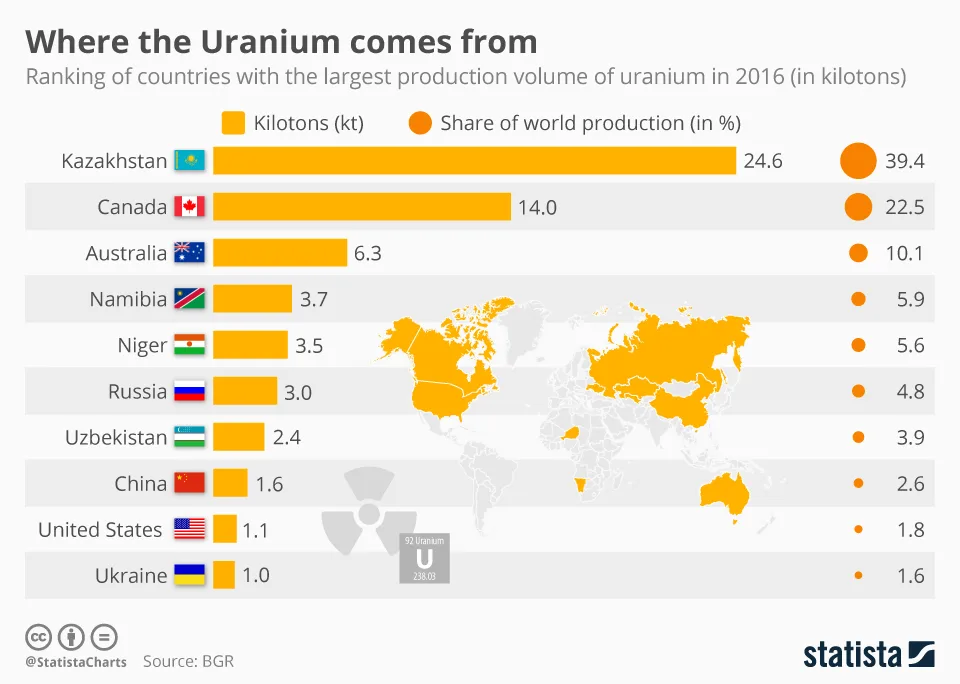

The region is home to almost 45% of the world’s known uranium supplies.

With a net-zero future relying heavily on nuclear power, world powers are scrambling to secure supply.

Last week, the French President visited Uzbekistan and Kazakhstan, in a major attempt to shore up the French nuclear power supply chain.

He took the CEOs of major French nuclear companies for talks with local officials.

The leaders of China, Russia, France (and even Turkey, Pakistan and Iran) have all been active in the uranium-rich region in recent months.

With uncertainty surrounding two of France’s major uranium suppliers —Niger and Russia — President Macron’s visit to Central Asia took on added significance.

Macron also went to Uzbekistan, where government owned Orano announced more uranium deals, including at least $500 million in investment in nuclear enrichment and mining.

The following week, Russian President Putin arrived in the country with a delegation, also partly focused on uranium.

In a sign of Kazakhstan’s growing power and influence; President Kassym-Jomart Tokayev largely chose to speak in Kazakh, not Russian.

This is an encapsulation of the tables turned in the Kazakhstan-Russia relations: President of Kazakhstan pulls a power move and opens his speech to the visiting Russian delegation headed by Putin speaking Kazakh. You can see the bewilderment and confusion among the delegation pic.twitter.com/fEpJB57frR

— Bakhti Nishanov (@b_nishanov) November 9, 2023

The leaders of Turkey and Iran have also scheduled visits.

President Xi of China was in the region earlier this year – signing off on uranium supply deals and LOIs.

China is building a massive fleet of nuclear power, to meet ambitious energy goals by mid-century.

Most of the supply output to China is set to come from the Kazakhs, via Kazatomprom (LSEI: KAP) – dual listed in London and on the Astana International Exchange.

The Kazakh Government holds about 75% stake in Kazatomprom through its sovereign wealth fund.

However, Canada’s Cameco (NYSE: CCJ) has also just announced a deal to supply North American uranium for China’s ambitions, which you can see in the chart below.

We may also see major deals announced in the coming months with other emerging players.

The two biggest state-owned nuclear companies, the China General Nuclear Power Corporation (CGNPC) and the China National Nuclear Corporation (CNNC) have to secure much more uranium to power the coming demand curve.

China aims to obtain 1/3rd of the supply domestically, 1/3rd from Chinese equity in foreign mines, and 1/3rd on the open market.

It will need 540 tonnes of uranium to produce an additional 20GW of electrical power by 2025.

The demand side story is even greater by the 2030s when dozens of new reactors will come online.

Russian influence on Kazatomprom

Meanwhile, Russia is using brute force to get access to Kazakhstan’s mines.

In May 2023, Kazatomprom’s board approved the sale of a massive new uranium mine to Russia’s uranium giant Rosatom.

Many senior managers resigned from Kazakhstan in protest.

For whatever reason, the company sold its Budenovskoye mine, projected to become the world’s biggest source of uranium.

The deal was done and forced through by Kazakhstan’s sovereign wealth fund, against the wishes of the leadership of Kazatomprom.

The power games, with China and France in the region, will no doubt continue to play out.