The Chair of global EV giant Tesla, Australian national Robyn Denholm, has joined a chorus of business leaders demanding Australia’s government offer tax incentives and investment to develop the downstream battery manufacturing industry in the nation.

The calls come as a game of geopolitical-critical minerals chess game plays out between China, the US, EU and others to secure critical minerals supplies needed for a low-carbon transportation future, marked by EVs.

Australia exports much of the world’s battery metals, especially lithium – about 47% of lithium supply comes from Australian mines as of 2021.

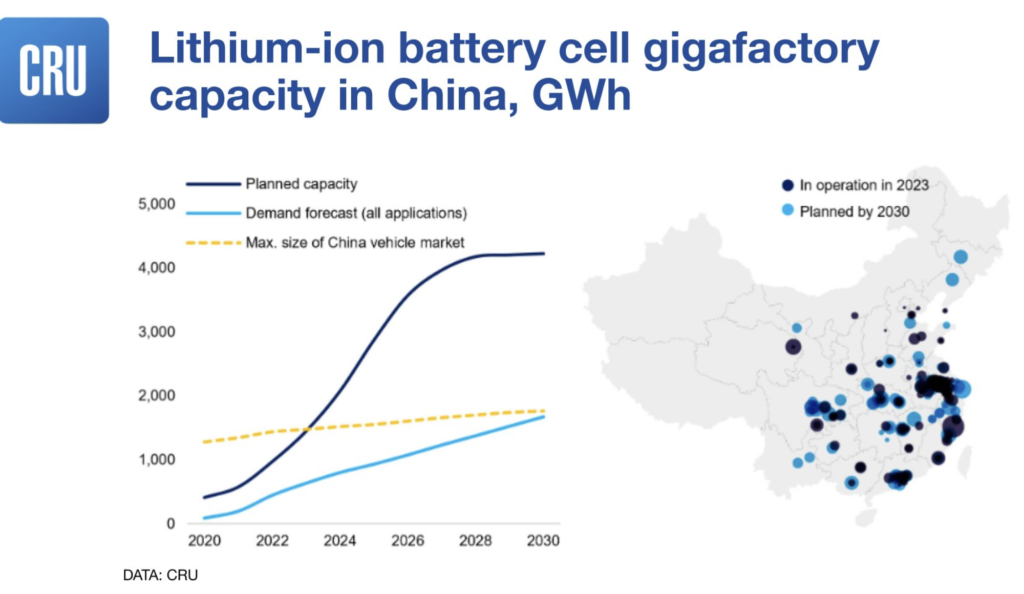

Lithium typically makes its way to China, where most battery manufacturing takes place. China controls about 60% of global refined lithium supplies and host signficant battery manufacturing power.

Car manufacturers and mining entrepreneurs are now calling on the Australian government to invest in pathways for local processing and manufacturing, rather than shipping direct to China.

Lithium battery sales are worth at least US$50 billion a year and growing.

“Australia can be more than a ‘dig and ship’ nation,” Tesla Chair Robyn Denholm told the Minerals Week conference in Canberra, Australia’s capital city.

“If we want to unlock the future potential of our future growth, we need to expand and reshape our industrial mindset and the battery opportunity is the one to focus on to help us with this ambition,” she told the conference.

“We can provide the spodumene and the ore. But we can also provide the concentrates, the reagents, the battery-grade fine particles, the precursors, the cathodes and much more. To do so we need to act boldly and swiftly.

According to the Australian Strategic Policy Institute, two Chinese manufacturers, CATL and BYD, dominate global lithium battery sales.

The near-oligopoly controls hold a 73% market share, according to GRU Group analysis. The huge planned manufacturing capacity has European and US carmakers worried, concerened China may flood the market with cheap cars, that would price out their models.

Chinese manufacturers gathered week at the IAA Mobility conference in Munich, Germany to “eat their (EU manufactuers) lunch,” Forbes magazine reported.

Of the top 10 manufacturers accounting for about 90% of sales, four are Chinese, three are South Korean and two are from the United States.

About half of the international lithium supply comes from Australia, although Canada is catching up.

The Australian government has so far been talking up the opportunity, however no concrete action has so far been taken to ensure Australia is able to add downstream capacity to battery metals.

“I want to make sure that we use the lithium and nickel and other products that we have to make batteries here. That’s part of the vision of protecting our national economy going forward,” Prime Minister Anthony Albanese told the National Press Club earlier this year.

Earlier this year the CEO and founder of MinRes, a major iron ore and lithium player, also called for more incentives for battery manufacturing and processing.

Billionaire Chris Ellison said the Biden administration’s Inflation Reduction Act (IRA) had incentivised US companies to buy up Australian lithium and other battery minerals mines while investing in downstream processing elsewhere.

This week, US chemical giant Albemarle looks set to acquire local lithium powerhouse Liontown Resources. However, a last-ditch bid by another player – possibly another Western Australian local iron ore billionaire Gina Rinehart, was underway.

Meanwhile, China is looking to secure more lithium supply from Australia.

However, Australian Treasurer Jim Chalmers has blocked three attempts by Chinese miners to buy projects this year, including barring the takeover of financially stricken lithium miner Alita Resources, the AFR reported.

.