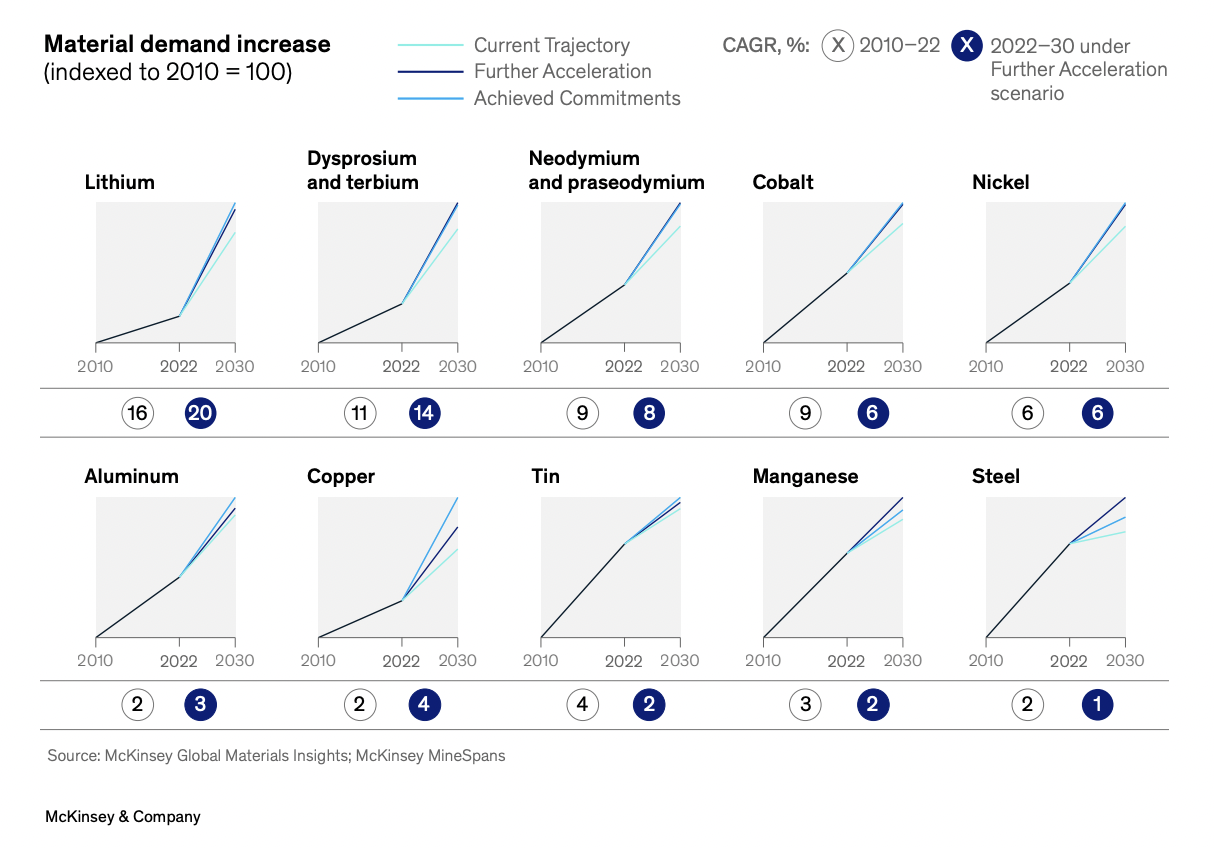

A new report on Critical Minerals by McKinsey suggested a shortage of rare critical minerals, including the mineral dysprosium, terbium, iridium, copper and tin could be crippling for the electric vehicle and renewable energy industries.

McKinsey released the report this week, which looks into the dynamics of critical minerals supply chains required for the green industrial revolution to take place over the coming years, key to keeping global warming in check.

According to the 24-page report titled, ‘The net-zero materials transition: Implications for global supply chains’ a key mineral for the production of batteries needed in EVs could be in short supply very soon.

The McKinsey report warns the government and industry about the impending mineral shortage in stark terms:

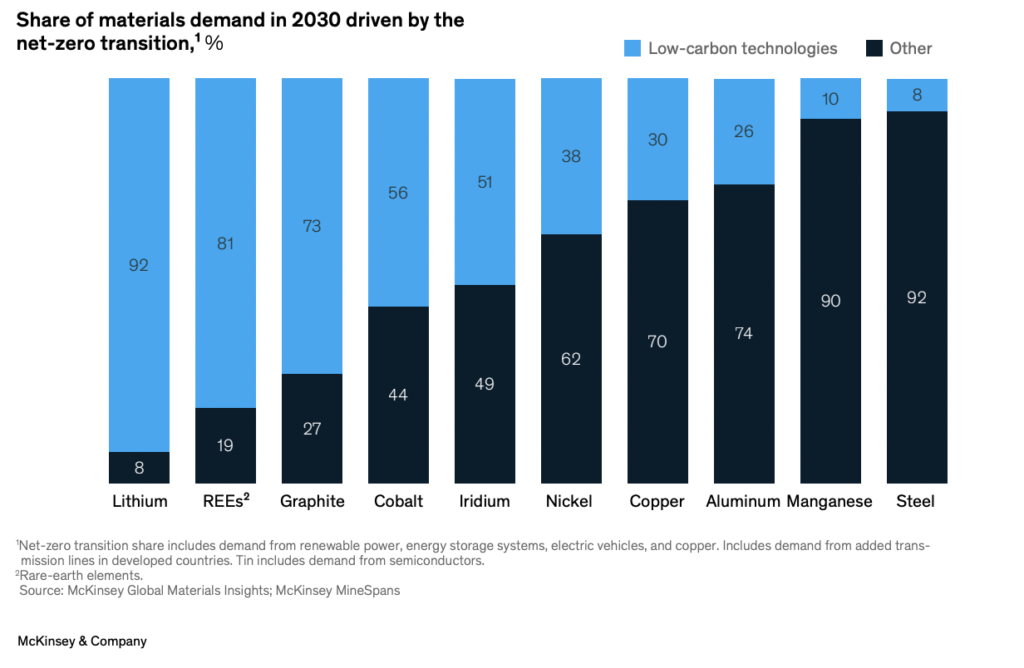

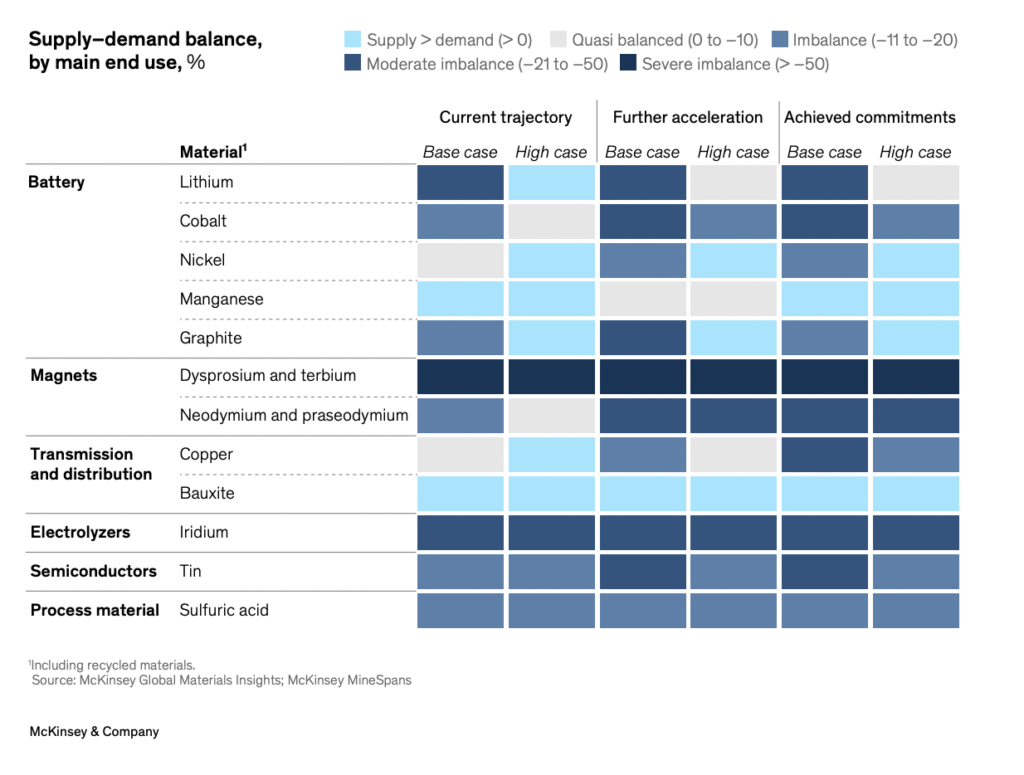

Dysprosium, which is magnetic material used in most electric motors, could see shortages of up to 70 per cent of demand. Unless mitigation actions are put in place, such shortages would likely hinder the global speed of decarbonization because customers would be unable to shift to lower-carbon alternatives.

The critical mineral is also almost entirely exclusively in the domain of China.

A recent separate report suggests the “automotive industry today uses most of the approximately 1000 metric tonnes of dysprosium produced yearly today and exclusively in China.”

Other reporting highlights suggest that at least $300 billion per year must be invested in new mining, refining and smelting capacity for critical minerals to keep up with decarbonisation trends to keep Earth from warming to dangerous levels.

“Investments in mining, refining, and smelting will need to increase to approximately $3 trillion to $4 trillion by 2030 (about $300 billion to $400 billion per year),” the team write.

Those supply chains will also need to be carbon neutral, using offsets or renewable energy sources to power the mine to the final product pipeline.

The report also highlights several minerals of concern, where the world could see severe shortages in the next few years alone:

Dysprosium and terbium, and neodymium and praseodymium (permanent magnets).

All magnet materials are expected to fall short, with rare earth elements such as dysprosium and terbium being the most constrained. This would limit the production of permanent magnets used in the electric motors of most BEVs and the drivetrains of wind turbines (as approximately 20 per cent of onshore and 70 of offshore wind turbines are currently using permanent magnet drivetrains).

Copper (electric wiring).

Copper is also expected to fall short in most scenarios, which would affect the build-out speed of transmission and distribution lines that connect renewable power sources to the grid and consequently the risk profile of renewable-energy projects.

Iridium (hydrogen electrolyzers).

Iridium is part of the platinum group of metals and is one of the scarcest materials in the world, with a global production of approximately 7,900 metric tons in 2021.10 It is expected to see a growing shortage as the demand for electrolyzers—especially proton exchange membranes—used in the production of low-carbon hydrogen likely increase exponentially in the coming years.

Tin (semiconductors).

Approximately 50 per cent of tin demand is driven by solder in semiconductors for electronic devices, in which it is used to attach components to printed circuit boards or other substrates. Because tin is expected to see a modest shortage, semiconductor supply chains could become constrained, which would directly affect the supply chains of most lower-carbon technologies.

Lithium, cobalt, nickel, manganese, and graphite (batteries).

Most battery materials, especially lithium and cobalt, would be constrained despite ongoing shifts in battery chemistry, including the reduction in cobalt intensity and the partial shift from nickel-manganese-cobalt (NMC) toward lithiumiron-phosphate (LFP) batteries.