Just a few years ago, Indonesia was a small player in the global battery minerals supply chain.

In 2014, Indonesia exported around US$1 Billion worth of EV-critical mineral nickel, by 2021 that rose to US$22 Billion.

Now, Indonesia has become a battery metals superpower, as it seeks to use new technology and an upstream manufacturing strategy to extract value from much-needed nickel, cobalt, graphite, tin and other critical minerals across its archipelago.

The nation is already the world’s biggest producer of nickel; with the mineral much closer to the surface than nickel sourced from other parts of the world.

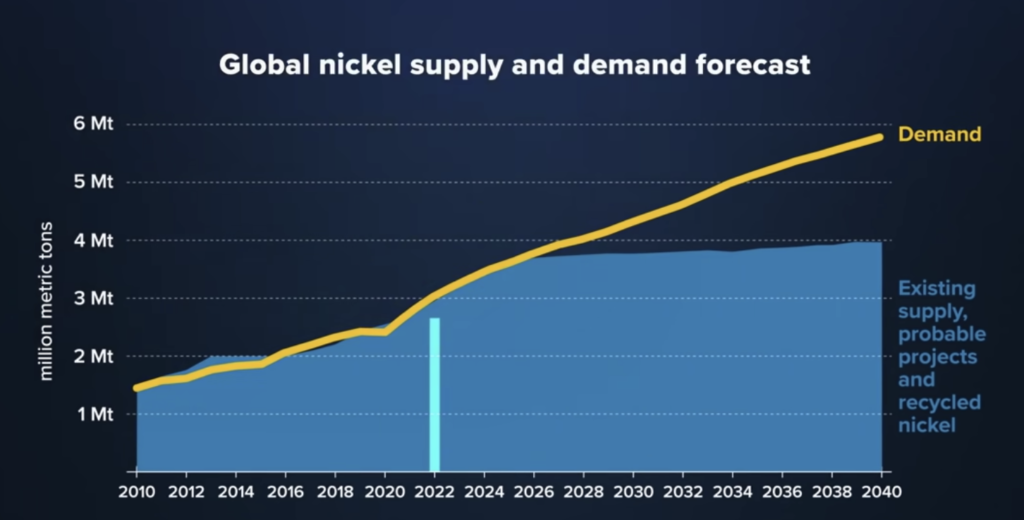

Wood Mackenzie projects demand for nickel will increase to nearly 6 metric tons by 2040 and 7.6 million metric tons by 2050 (source)

Global car makers, eager to source nickel for long-range EVs, desperately need the mineral as part of the mix.

Firms from China, the US, EU and South Korea, are investing significant sums in nickel extraction capacity in partnership with local firms. Around US$30 Billion has already been committed to adding capacity.

According to an analysis from Macquarie Bank, the ASEAN nation is set to supply 65% of the world’s nickel by 2025, up from 30% in 2020. This could rise to 80% by the 2030s, according to a separate analysis.

New techniques and environmental concerns

Indonesia faces a number of significant local environmental issues with nickel extraction, including the stripping of rainforest areas.

According to a recent article in The Economist, Indonesia is banking on a process known as high-pressure acid leaching (HPAL) to extract nickel from limonite ore, the most abundant nickel ore, to meet its supply goals.

New processing plants using this technique are being built across Indonesia.

The rotary kiln electric furnace (RKEF) technique is still the most commonly used and is ideal for saprolite nickel ore. However, this process also required significant energy, typically from coal fire power. To complicate things, Indonesia has already dug up and exported much of the saprolite ores ideal for this process – to such an extent export of those ores was prohibited in 2020.

It appears nickel extraction using HPAL is the ideal way forward.

However, this method requires large reserved areas to store tailings; so balancing the required technology with concerns about protecting local environments will be essential. In 2021, Indonesia barred deep-sea tailings disposal, due to its environmental dangers.

Either way, Indonesia is all in on feeding the world’s massive demand for batteries.

Bauxite Ban

Just a few weeks ago, Indonesia moved to ban the export of raw Bauxite, another mineral critical for the green energy revolution.

The government is looking to add new smelting capacity for aluminium.

Downstream processing

Indonesia’s government is looking at more strategic moves to add downstream capacity; increasing manufacturing investment and frustrating companies looking to simply to receive the raw minerals from the developing nation.

China is looking to build 23 facilities to extract nickel via HPAL processes, South Korea and the US are also working to invest in EV battery mineral extraction and manufacturing capacity.

Ford is investing $4.5 billion into a local plant, and Hyundai is investing in capacity in partnership with LG to build battery plants.

Australia recently signed an MOU with the Indonesian President on “collaboration to develop value-adding critical minerals and battery industries.”

Analysts suggest Indonesia needs lithium from Western Australia to ensure it has the downstream capacity to build EVs locally.

The Widodo government wants the Indonesia Battery Corporation (IBC) to become a hub of electric vehicle battery manufacturing in the region.