Financing for several major farm developments across the globe, crucial to green energy targets, has suddenly collapsed.

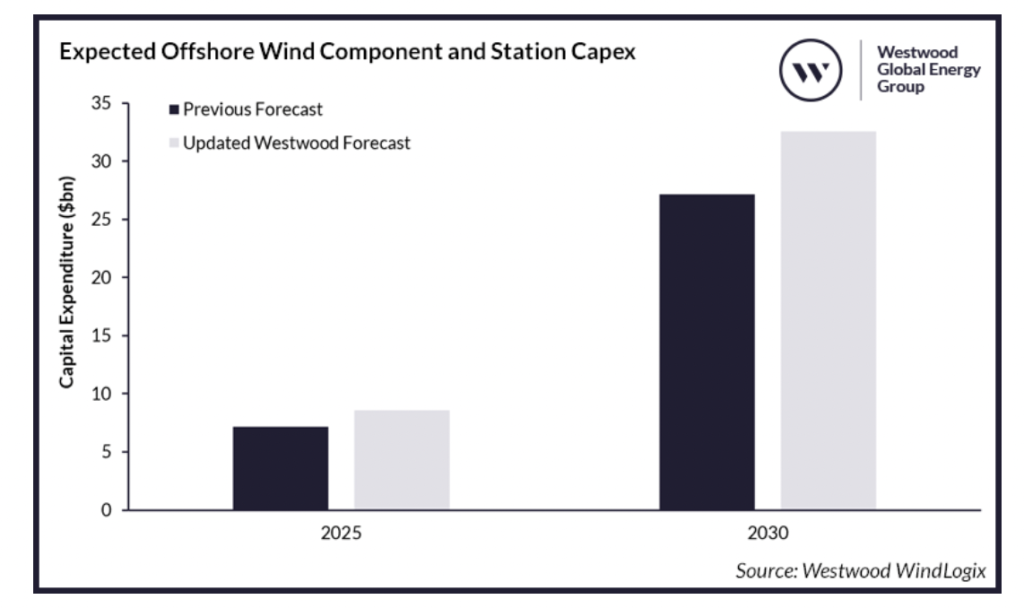

Cost blowouts could result in an additional US$280 billion to wind farm projects globally by 2030.

Reports in the last week alone suggest major wind farm projects in the US and the UK have been shelved due to surging costs.

“Energy coming from these projects is desperately needed,” said Helene Bistrom, head of Sweden’s state-owned utility Vattenfall AB last week.

“(Yet) with new market conditions, it doesn’t make sense to continue (the projects).,” she noted.

In just the past few days, Spain’s Iberdrola SA agreed to cancel a contract to sell power from a planned wind farm off the coast of Massachusetts.

Danish developer Orsted A/S lost a bid to provide offshore wind power to Rhode Island and Vattenfall AB scuttled plans for a wind farm off the coast of Britain.

Even old school fossil fuel companies, who had started to invest a small amount of their massive revenues into renewables, are starting to pull out of projects.

“Returns on offshore wind are becoming more and more challenged,” Shell CEO Wael Sawan told Barron’s last month, just days after a Shell joint venture said it would pull out of a power contract in Massachusetts.

Shell won’t build renewable projects that can’t earn initial returns of 6% to 8%, he said, the magazine said.

Many other wind farm projects around the world are facing major delays due to costs.

A recent analysis said German investment in renewable projects was significantly behind schedule, at a time when nuclear energy has been switched off and demand increasing during the hot European summer.

To achieve the target of 10 gigawatts (GW), or 10,000 MW, of new energy production capacity per year starting in 2025, at least 12 GW of new approvals annually are required.

“Just the time to get the permit takes two and a half years,” Ralf Paschold, an onshore wind power entrepreneur in the central German state of Hessen, told DW. “Why? Because the process is too difficult.”

The collapse of these projects came just a month after Energy Intelligence reported the Wind Renewable Energy sector faced huge cost blowouts.

“The global commodity inflation has adversely affected both onshore wind and offshore segments. We see price escalation across the value chain,” Sashi Barla, head of research, renewable power at consultants Brinckmann, told Energy Intelligence.

The report suggests a number of factors are at play:

Commodity prices

For important components for wind turbines have shoot up.

Wind turbines need a vast and wide range of metals for production, including:

Rare earth metals like neodymium, dysprosium, copper, ion, steel, aluminium, nickel, lead, lithium, titanium, fibreglass

“Our development and production of gearboxes and powertrains for wind turbines is closely related to the evolution of prices in transport, steel and energy. Recent strong swings in the above elements resulted in significant cost inflation,” ZF Wind Power, a Belgium-based manufacturer of gearboxes and powertrains for wind turbines said.

Financing Costs

There has also been a huge jump in financing costs, against a wider financing cost landscape for energy projects, fueled by global inflation and increases in lending rates across the world. Consortiums of banks financing major projects have had to re-negotiate deals and find wider partners to fund planned opex.

Some projects have blown out by over 30% since 2021 alone.

Labour

Higher labor costs and a shortage of skilled workers around the world are increasing as workers seek higher wages to offset rising costs in their home countries.

While government have ambitious targets for renewables, high costs and other complexities will continue to plague the sector.

Joe Biden’s inflation reduction act is also taking a significant investment into wind farms off the US east and west coasts. Some 25% of America’s renewable energy needs will need to come from offshore wind farms alone.

Many skilled workers and project equipment is finding their way there and European, APAC and other global projects are facing a scarcity of resources.

Hundreds of Billions in Cost Blowouts

One estimate said the scramble for capacity will add some US$280 billion in costs.

“With margins in many parts of the industry already being squeezed due to attempts to make offshore wind more cost competitive in general, cost inflation may prove extremely challenging for some businesses. At this stage, however, most of our respondents appeared committed to the offshore wind industry and were not seeking to reduce headcount or withdraw from the industry.”

“Whatever happens next, industry players will be closely watching how a period of cost inflation affects a sector that has been defined by falling costs for some time,” Peter Lloyd-Williams, Senior Commercial Wind Analyst, Westwood told Offshore Engineer.