A new report on critical minerals has just dropped, this one is from the International Renewable Energy Agency.

As many of us know, with the pressure to accelerate the green energy transition – in line with the 1.5°C global warming as outlined in the 2016 Paris Agreement pathway – a vast deployment of energy transition technologies is required by 2030.

IRENA’s World Energy Transitions Outlook (WETO) estimates that an average of 1000 GW of renewables will need to be deployed annually and hundreds of billions of dollars will be required each year, estimated in other reports to be around $4 Trillion by 2030.

The report outlines the diplomatic and international approaches needed to ensure the world can meet its targets, both to supply global industry to build the new energy infrastructure and meet climate goals.

WETO also emphasises that rapidly enabling green energy infrastructure will be essential to accommodate high shares of solar and wind, cross-border electricity trade, electrification of end uses such as transport, and green hydrogen production and trade.

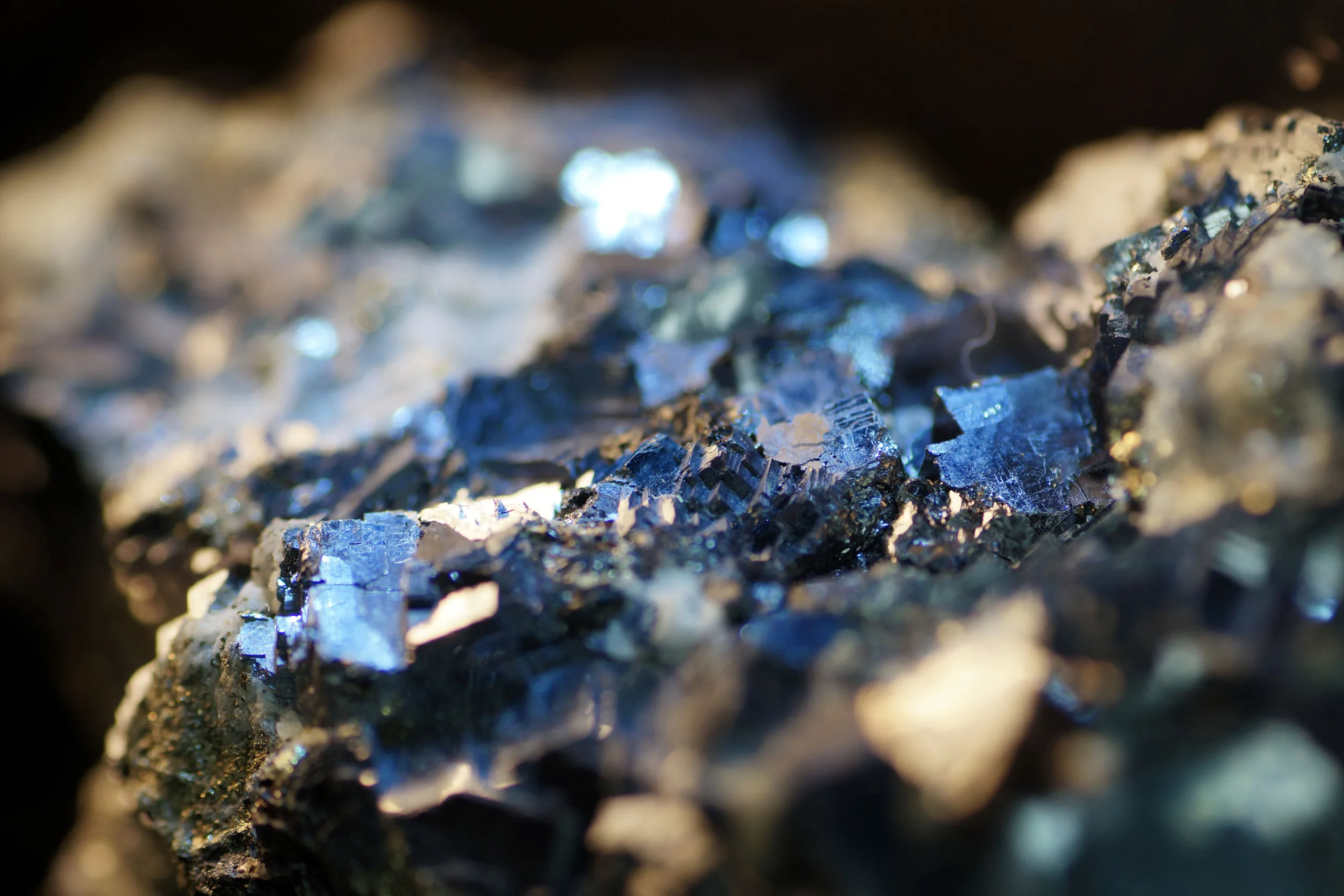

Combined with new technical innovations requiring rare earths, these technologies are dramatically increasing the demand for critical materials.

The report speaks to the need for countries to work together to build critical minerals supply chains and manufacturing capacity. Alliances and intergovernmental working groups must be forged.

The report notes today, the mining of critical materials is highly concentrated in specific geographical locations. Australia (lithium), China (graphite, rare earths), Chile (copper and lithium), the Democratic Republic of Congo (cobalt), Indonesia (nickel) and South Africa (platinum, iridium) are the dominant players.

Processing is even more geographically concentrated, with China accounting for more than 50% of the world’s refined supply of (natural) graphite, dysprosium (a rare earth), cobalt, lithium, and manganese.

The report suggest more efficient allocation of resources must be secured across borders.

A number of issues lie in the way, including regulation, critical minerals cartels, supply shocks, environmental considerations, deep sea mining, and critical minerals nationalism.

“Only a handful of countries have all the minerals to produce (required energy infrastructure).

“This means that pooling mineral supplies would benefit the majority of countries if they were to build downstream industries,” the report says.

“Moreover, developing countries could also create bigger markets. Proximity to downstream consumer markets is an important success factor in attracting higher-margin activities in the (energy infrastructure) value chain – probably more important than proximity to mineral resources.”

PRIVATE SECTOR MOVES

The report highlights how the private sector is working to develop solutions to critical minerals shortages, including:

Tesla will source its cobalt and other critical minerals only from suppliers meeting its environmental and social standards. It is also developing new battery chemistries to reduce its reliance on cobalt for its batteries.

Apple has developed a responsible sourcing programme, which requires its suppliers to follow stringent environmental and social standards, and covers several critical minerals, including cobalt, tantalum, tin, tungsten and gold. Apple works to promote responsible mining practices through its participation in the RMI.

Ford has developed a sustainable materials strategy, which focuses on critical minerals such as cobalt, lithium and rare Earths. It is working to identify and address environmental and social risks in its supply chains and is collaborating with suppliers to promote responsible sourcing practices.

Rio Tinto has developed a responsible sourcing programme, which covers several minerals, including copper, aluminium and diamonds, and focuses on human rights, environmental sustainability and community engagement. The programme involves working with suppliers to address risks and improve practices.

BMW has established a sustainability programme, which focuses on the responsible sourcing of critical minerals such as cobalt and lithium. BMW works with suppliers to promote sustainable practices and has committed to using only certified sustainable raw materials in its products by 2030.

Volkswagen has created a comprehensive sustainability programme, which focuses on the responsible sourcing of critical minerals such as lithium and cobalt. Volkswagen works with suppliers to ensure they comply with its environmental and social standards, and it also invests in new technologies to reduce its reliance on critical minerals in its products.

Umicore ensures sustainable procurement of battery materials (cobalt, lithium, nickel) through a framework, which includes transaction and logistical systems, quality checks, chemical fingerprinting and stakeholder engagement.

Our Report Summary:

To avoid a demand-supply gap for critical materials, mining and processing capacities must be increased.

There is no scarcity of geological reserves, and new discoveries are being made.

DISRUPTIVE INNOVATION

Technological innovation affects the demand for materials through factors such as substitution, efficiency improvement, design optimisation and the introduction of new materials.

Uncertainties in projecting the demand and supply gap for critical materials: The example of electric vehicle batteries

Lithium iron phosphate batteries emerged in the 1990s from the laboratory of John Goodenough, who had won the Nobel Prize for lithium-ion batteries. However, automakers did not take interest in LFP batteries until cobalt and nickel became significantly more expensive.

The rapid expansion of lithium-ion polymer batteries (LFP) in China cannot be linked solely to innovation, as China’s preference for LFP batteries results from uncertainties regarding the availability of cobalt and nickel at affordable prices.

Today, lithium-ion batteries hold a 70% market share due to their high performance. However, emerging battery technologies such as sodium-ion batteries have the potential to disrupt the EV battery market by replacing critical materials such as lithium and cobalt with less expensive or more abundant options.

Rare earth elements are ubiquitously used for permanent magnets in electric generators and electric motors, but efforts are being made to replace neodymium with other rare earth elements or to develop rare earth free permanent magnets.

Innovation in solar photovoltaic technology may alter the demand for raw materials, prompting a shift away from silicon in conventional crystalline silicon and less-efficient thin-film solar power technologies.

SUPPLY CHAIN

After acquiring the necessary permits and licenses, mining companies undertake several steps before extracting resources from the ground. These processes can take several years and involve significant costs.

The mining stage begins with the extraction of mineral ores from open-pit or underground mines using drilling and/or blasting techniques. The extracted ores are transported to a nearby processing plant where they are converted into shippable products through multiple steps.

The next stage is metallurgy or refining, which involves various techniques such as smelting, roasting and electrolysis. The final product is sold to manufacturers, who use the metal in a wide range of areas.

Geography of mineral mining and processing

The mining of materials is highly concentrated in specific geographical locations, with China being the dominant player with a 100% share of global refined supply for natural graphite and dysprosium.

Global critical mineral reserves are relatively more evenly distributed than current mineral production, and there are many unexplored areas in developing countries. This opens opportunities for diversifying supply but requires increased global exploration spending and continuous collection and sharing of mineral resource data across continents.

MINERAL EXPLORATION

The majority of exploration budgets for selected minerals come from countries of the OECD, dominated by Australia, Canada, Chile and the United States. China and Viet Nam increased their exploration budgets in recent years.

Industry players

The mining industry is dominated by a few large multinational corporations and state-owned/controlled enterprises, which control a significant portion of global production and trade.

A mining company’s ownership structure can impact its risk tolerance and the environments in which it operates. Chinese SOEs are a notable example of this.

Some companies in the mineral and metal industry value chain are vertically integrated, meaning they operate across multiple stages of the value chain. Other companies specialise in specific stages.

The energy transition is changing corporate strategies and value chains in the mining industry. BHP, the world’s largest mining company, is divesting its oil and gas business and positioning itself as a mining company focused on the energy transition.

METAL EXCHANGES

Transition metals and minerals are not widely traded on exchanges, and the low liquidity and product heterogeneity pose challenges to the development of effective hedging tools.

The London Metals Exchange was set up in 1877 by merchants and financiers to facilitate international metal trading. Today, the LME is the world’s foremost metal trading platform, setting global reference prices for critical materials such as copper, nickel and cobalt.

Commodity futures and derivatives are also traded on smaller exchanges, but cobalt and lithium contracts have not yet received wide acceptance as hedging tools by industry participants.

Metal exchanges play a crucial role in price signalling as they provide unambiguous price information. However, it is difficult to ascertain the actual agreed-upon price for metals that are often traded directly between parties.

COMMODITY TRADING

Independent traders play a key role in the fragmented nature of some mineral markets, matching producers and consumers in different parts of the market.

Copper is the most valuable material by trade value.

China is among the top importers of critical materials, even though it dominates the midstream and downstream capacity for many critical materials.

Three caveats must be considered when examining trade dependencies: first, import transactions are at times attributed only to the country of last shipment; second, minerals can be embedded in imported finished and semi-finished products; and third, foreign firms can own and control mineral assets and operations partially or completely.

SUPPLY RISKS AND VULNERABILITIES

All countries are susceptible to unforeseen supply interruptions since none are self-sufficient in all materials. Even countries with a smaller manufacturing base are prone to trade disruptions.

Supply chain disruptions can affect multiple industries, including solar panels, wind turbines and batteries, and could reverberate throughout the economy.

One review identified no less than 30 indicators of supply risk. Risk assessments can be conducted at different levels.

Geopolitical risks should be assessed considering the geographical concentration of mining and processing, the decline in mineral ore grades, the limited extent of end-of-life recycling, and the dependence on by-products for many critical minerals.

EXTERNAL SHOCKS

Global critical material supply chains are susceptible to disruptions, which may be caused by natural events, human action, or both. In recent years, the supply chains have been disturbed by shocks such as the COVID-19 pandemic, the war in Ukraine and the global energy crisis.

Metal markets recovered from the initial price and demand collapse in March 2020, but faced several major disruptions ever since, including the 2021-2022 global energy crisis, which affected China’s magnesium plants and platinum group metals production in South Africa.

The war in Ukraine disrupted certain commodities, such as nickel and aluminium, and led to price surges. The sanctions have so far avoided blanket restrictions on the import of key metals, instead introducing selected import duties and tariffs.

Climate change could have an impact on the critical material value chain. For example, nickel, cobalt and rare earths are mined and processed in areas that are likely to be at a greater risk of heavy rainfall and floods.

In recent years, many governments have increased state control over their mineral resources to enhance the benefits from extraction or address adverse impacts.

RESOURCE NATIONALISM

A royalty payment dispute in the Democratic Republic of Congo and Chile’s decision to nationalise the lithium industry could impact global supply.

The trend of stricter mineral sector regulations is reminiscent of the 1970s, when many mineral-rich countries adopted state-interventionist policies and set up state-owned natural resource companies in the minerals sector. The trend was swept by a wave of liberalisation, deregulation and privatisation of state assets in the early 2000s.

CHILE’S LITHIUM STRATEGY

Chilean President Gabriel Boric announced the country’s decision to nationalise its lithium industry in April 2023. He stated that the government would protect biodiversity and share mining benefits with indigenous and surrounding communities.

Under the plan, a separate state-owned company would be created to produce lithium in Chile, and future contracts would be issued through public-private partnerships.

Analysts are concerned that nationalisation of the lithium industry may deter potential partners and shift foreign direct investments to other countries, but the government has indicated a gradual and pragmatic approach to bringing the sector under state control through partnerships.

Many countries have increased scrutiny of foreign investments, not just in the mining industry but across various sectors. These increased scrutiny measures reflect concerns about national security, environmental sustainability, and local ownership and control over natural resources.

EXPORT RESTRICTIONS ON CRITICAL MINERALS

Export restrictions on raw materials are a growing concern in international trade, with several countries implementing major export bans. These measures reflect a growing trend of countries taking steps to encourage domestic processing and attract downstream industries.

Export restrictions on raw materials are not a new phenomenon. They are often imposed by countries seeking to reduce reliance on raw material imports.

Quantitative import and export restrictions are largely prohibited under the WTO’s General Agreement on Tariffs and Trade, except under certain limited exceptions.

The increasing trend of export restrictions on critical materials has triggered a series of trade conflicts, some of which are being addressed at the World Trade Organization (WTO).

Export taxes are not subject to WTO regulations, except for some recently acceded members.

RARE EARTHS CRISIS

Rare earths are a group of 17 chemical elements used in modern, high-tech applications. China became the biggest producer in the early 2000s, but in 2010 it decreased its export quota for rare earths by 37%, resulting in a surge in rare earth oxide prices.

Chinese rare earth exports to Japan were reportedly interrupted for a few weeks in 2010 after the detention of a Chinese fishing trawler’s captain amid a maritime dispute.

Japan, the EU and the US requested a World Trade Organization consultation over Chinese rare earth export restrictions. The Appellate Body decided in favour of the complainants.

MINERAL CARTELS

Mineral production is concentrated geographically, and large corporations dominate key segments of the mineral value chains. This could lead to the formation of commodity cartels.

Historically, producer groups and governments have made various attempts to influence mineral markets through collusion. These attempts were often short-lived, however, due to issues such as internal discord, non-participation of major producers, and mineral substitution or innovation in supply and demand technologies.

There have been several international commodity agreements involving both producers and consumers, including a series of agreements that governed the tin market from 1956 till 1985. These agreements aimed to stabilise the tin market by establishing a buffer stock system.

Prospects for cartelisation in the platinum, nickel and lithium markets

Most new proposals will struggle to meet all the conditions for a successful commodity cartel, which include dominant producers with substantial market shares, high entry barriers, and product homogeneity.

Demand elasticity is another crucial factor that affects the feasibility of a commodity cartel. If a product is highly elastic, a cartel may have limited control over price.

The Russian Federation and South Africa signed a memorandum of understanding on platinum group metals at the March 2013 BRICS summit.

There are major obstacles to the creation of a PGM cartel since none of the countries has a state-owned company monopolising PGM mining. Furthermore, production cuts designed to increase prices could lead to job losses in the labour-intensive PGM industry.

Indonesia, the world’s largest nickel miner, is considering the potential establishment of an Organization of the Petroleum Exporting Countries (OPEC)-style organisation for certain battery metals.

In 2022, 172 159 people were directly employed in PGM mining in South Africa, higher than the jobs in coal, gold or any other mining sector. However, major nickel producers are not supportive of the idea of the OPEC-style organisation.

Product heterogeneity could be another obstacle to creating a nickel supply cartel. Higher-grade nickel ores are found in Australia, Canada and the Russian Federation, while lower-grade nickel ores are found in Indonesia and the Philippines.

Unlike petroleum, there are ample opportunities to shift demand away from nickel. Innovation in battery chemistry, recycling, and manganese-rich cathodes could further reduce the demand for nickel.

Argentina, Bolivia and Chile are in talks to establish a lithium cartel, but Australia is unlikely to participate. Additionally, many countries have identified significant untapped lithium reserves and resources through ongoing exploration.

Lithium is mined from brines and hard rock ore, especially spodumene, and is used in EV batteries. Sodium and air metals can replace lithium, although every change comes with trade-offs in terms of cost, performance and security of supply.

Instabilities in mineral-extraction countries can disrupt mineral supply, for instance by causing a sevenfold surge in the price of cobalt in 1978, and a shift from cobalt to rare earths for manufacturing permanent magnets in 2010.

In 2021, Myanmar’s mining sector saw protests and strikes, which caused an 80% decline in export earnings from minerals.

MARKET MANIPULATION

Critical material markets, like other commodity markets, exhibit a cyclical nature, exhibiting a classic boom-bust pattern. This is partly due to the extended lead times required to establish new mines.

Critical minerals such as cobalt, indium and tellurium are often by-products of other mined base metals, and are therefore indirectly influenced by price increases due to the peculiar nature of by-product production.

Market manipulation can exacerbate price volatility and supply chain disruptions in mineral and metal markets, particularly small ones with little liquidity. In the past, there have been numerous attempts to manage the market and influence prices, creating concerns over corporate market manipulation.

The LME suspended nickel trading in March 2022 after prices surged by over 250% in just two days. The market remains unstable, with trading volumes falling sharply and prices experiencing frequent uncontrolled swings.

These incidents have prompted financial regulators and exchanges to introduce new rules to prevent market manipulation. However, the effectiveness of these efforts remains to be seen.

CRITICAL MINERALS ADVANCED EXPLORATION

The Arctic region is known to have vast reserves of critical materials such as nickel, zinc and rare earths. New deposits are being discovered, and the region has seen increased military presence, but most scholars see a low likelihood of conflict over resources.

Outer space is becoming a new frontier in the race for critical materials, with countries such as China, the Russian Federation and the United States vying for a foothold in this emerging industry.

The race for minerals could trigger geopolitical conflicts over ocean seabeds, as some countries are already exploring deep-sea deposits. However, a regulatory framework remains incomplete, and member countries have opposing views on how to proceed.

DEEP SEA MINING

Deep-sea mining is becoming increasingly popular, with 22 state and private contractors holding 31 exploration contracts to search for valuable metals with high-grade ore.

Deep-sea mining raises concerns regarding environmental impacts, including marine habitat destruction and the release of toxic chemicals. The European Commission wants to prohibit deep-sea mining until scientific gaps are properly filled, no harmful effects arise from mining, and the marine environment is effectively protected.

Deep-sea mining is regulated by the International Seabed Authority, an intergovernmental body of 167 member states and the European Union. It is also required to ensure the protection of the marine environment.

MINING AND CONFLICT

The race for minerals can exacerbate or contribute to local armed conflict in multiple ways, including by linking to local grievances, conflict and human rights abuse.

Mineral riches can contribute to conflict in several ways, including the stirring of conflict over the fair distribution of benefits and costs among the local population, and the funding of armed groups by exploiting green mineral deposits, leading to increased violence and instability.

Certain mineral resources are less likely to be involved in local conflicts than others, such as bauxite, lithium and graphite, which have low value-to-weight ratios and are not profitable to non-state armed groups.

If managed well, the energy transition can catalyze economic growth, alleviate poverty, and enhance social and environmental outcomes by expanding access to reliable and affordable energy, and diversifying critical material supply chains.

This chapter discusses human security risks associated with mineral development, including impact on indigenous communities, human rights, labour conditions, climate change, land use and water security.

Mining displaces indigenous communities and can lead to the loss of land and natural resources, and the forced relocation of entire communities.

According to a recent survey, 54% of energy transition mineral projects are located on or near indigenous peoples’ land. These projects are often located in highly vulnerable settings, with platinum having the highest co-occurrence of three contextual risks.

SMALL SCALE MINING

Worldwide, almost 45 million people are engaged in artisanal and small-scale mining, with another 134 million indirectly involved.

The ASM sector is not formalised and inadequately regulated, making it one of the most dangerous professions. Child labour is a major challenge of this low-cost, low-tech and labour-intensive industry.

ASM mining is frequently associated with substantial environmental degradation, including deforestation and pollution of water and soil resources.

The lack of a formal structure and wide geographical reach of ASM could potentially lead to conflict, violence and terrorism.

In recent years, several governments have attempted to introduce ASM reforms, but have had the unintended effect of causing miners to operate illegally. A bottom-up approach to policy making is needed to foster a conducive climate for ASM activities.

CLIMATE CHANGE

The energy transition is a crucial response to climate change, which could potentially multiply threats to geopolitical stability.

The metals and mining sector is responsible for 10% of global greenhouse gas emissions.

Most metals are refined in countries with a coal-based grid, and the electricity mix is therefore a major determinant of their overall emissions.

Aluminium, cobalt, nickel, silicon and rare earth elements have the highest annual energy consumption and emissions.

Renewable energy technologies emit a fraction of the greenhouse gases emitted by fossil fuel technologies, even though they require more minerals than the latter.

It is possible to reduce emissions from mineral mining and processing by increasing energy efficiency investments and a shift to cleaner fuels and low-carbon electricity.

First Quantum Minerals and Anglo American are already taking steps in this direction.

End-of-life management can reduce emissions related to mineral mining, even if it may not eliminate them completely. Increasing recycling can aid in the shift towards a more sustainable energy system.

MITIGATING SUPPLY CHAIN VULNERABILITY

Governments have developed strategies to mitigate the vulnerability of global supply chains by promoting domestic production and reducing dependence on any single supplier.

A growing number of countries are compiling or updating national critical material strategies to offset potential supply risks and boost their mining sectors.

Australia’s Critical Minerals Strategy aims to boost regional jobs and growth through a thriving mineral sector, and help Australia move into downstream processing and capture higher-value-added products.

Brazil launched a national strategic pro-minerals policy in 2021 and created a Mineral Policy National Council in 2022 to oversee mineral-mining projects.

In 2023, the European Commission proposed the Critical Raw Materials Act, which set out four objectives: strengthening capacities, diversifying external supply, monitoring supply risks, and increasing the circularity and sustainability of critical raw materials consumed in the Union.

The regulation sets out a framework to select and implement strategic projects, creates a European Critical Raw Materials Board, and discusses strategic partnerships with third countries.

India’s National Mineral Policy aims to promote domestic industry, reduce import dependency and feed into the Make in India initiative. It emphasises the need for environmentally sustainable mining practices.

Japan’s new International Resource Strategy emphasises the importance of stockpiling rare metals and seeks to strengthen co-operation with countries involved in various stages of the supply chain.

South Africa’s government released its Exploration Strategy and Implementation Plan for the Mining Industry in April 2022, which aims to attract foreign investment, accelerate new mineral discoveries and promote the responsible use of the country’s mineral resources.

In July 2022, the UK government adopted its Critical Mineral Strategy, which aims to mitigate risks and make critical mineral supply chains more resilient through an “A-C-E approach” to critical minerals.

The United States has issued multiple executive orders on critical materials, including one in 2017 that tasked the Department of Commerce to develop a federal strategy on critical materials. The strategy relies on three key pillars: diversifying supply, developing substitutes, and improving reuse and recycling.

Countries are compiling lists of critical minerals based on their industrial needs and a strategic assessment of supply risks. The copper and platinum group are featured on just two lists.

SUPPLY CHAIN DESIGN

Recent supply chain disruptions have driven many countries to pursue supply chain localisation for greater strategic autonomy and to reduce dependence on potential adversaries. Critical and strategic mineral supply chains are also covered by these efforts.

Adopting reshoring, nearshoring, friend-shoring and associated policies can reduce geopolitical risks, increase national and regional strategic autonomy, and improve energy transition priorities. However, they may also entail significant risks, such as increased costs and reduced economies of scale.

Efforts to rewire critical mineral supply chains face notable challenges, including NIMBY (Not in My Backyard) protests, environmental issues, and long lead times to bring new mining, refining and processing capacities online.

Local communities in Serbia have raised concerns about the Jadar lithium mine’s potential environmental impacts, and Rio Tinto’s license was revoked amid public protests.

CRITICAL MINERAL DIPLOMACY

Critical raw materials have gained significance in international diplomacy, and the G7 members are pursuing the idea of creating a buyers’ club for critical minerals.

China has been building strategic alliances with multiple African countries to secure its resource supply lines and has successfully expanded its influence in critical mineral supply chains.

Since 2011, the EU has been pursuing raw materials diplomacy with non-EU countries, including Argentina, Brazil, Canada, Chile, China, Colombia, Egypt, Greenland, Japan, Mexico, Morocco, Peru, Tunisia, the United States, Uruguay and the African Union.

Importing states can contribute to equitable and sustainable development by fostering partnerships, advocating responsible sourcing practices, supporting capacity building in producing countries, promoting transparency and accountability, and investing in sustainable initiatives.

STRATEGIC STOCKPILING

Industrialised countries have established stockpiles of strategically important imported commodities to cope with potential shortages. However, reliable data on the size and location of these stocks are currently unavailable.

Stockpiling raw materials for clean energy manufacturing differs from stockpiling combustible fuels, and gallium restrictions would impact thin-film solar panel manufacturers, but existing solar panels would not be affected.

Stockpiling could limit the speed and scale of the energy transition by impeding supply chain diversification and hindering countries from reaching their potential in local value creation.

The US government began stockpiling critical minerals in 1939, and expanded them further in the early 1950s in response to fears of shortage due to the Korean War. The stockpile has been released on only ten occasions between 1945 and 2008.

The State Reserve Bureau, a government agency, buys and stores minerals in vast quantities when prices are low and releases them into the market when prices increase.

Many countries have strengthened their stockpiling policies, including Japan, which raised the target number for stockpiles to 60 days in 2020 and the Republic of Korea, which increased its stockpiles to 100 days in 2021.

Not all major industrial regions have implemented strategic stockpiling policies. The EU’s Critical Raw Materials Act encourages voluntary measures and requires member countries to submit reports.

REPORT CONCLUSION

The energy-driven mineral boom offers a chance to rewrite the legacy of the extractive industry. Known issues surrounding mining practices need a proactive response from both nations and corporations. Importer and exporter countries must collaborate to develop supply chains that uphold clear standards regarding human rights, environmental concerns and community engagement.

These standards are essential to human security and their absence is one of the root causes of geopolitical instability.

A global effort under the auspices of the United Nations could play a key role in ensuring critical material value chains are fair, equitable and transparent.