Unveiling the History of Uranium Mining, the Price Fluctuations Over Four Decades & The Future of Nuclear Power.

Uranium, a naturally occurring radioactive element, has played a significant role in shaping the energy landscape and has been a crucial component in nuclear power generation. As the primary fuel for nuclear reactors, the demand for uranium has experienced various shifts over the past four decades. This article delves into the fascinating history of uranium mining and the dynamic price fluctuations it has encountered from 1983 to 2023.

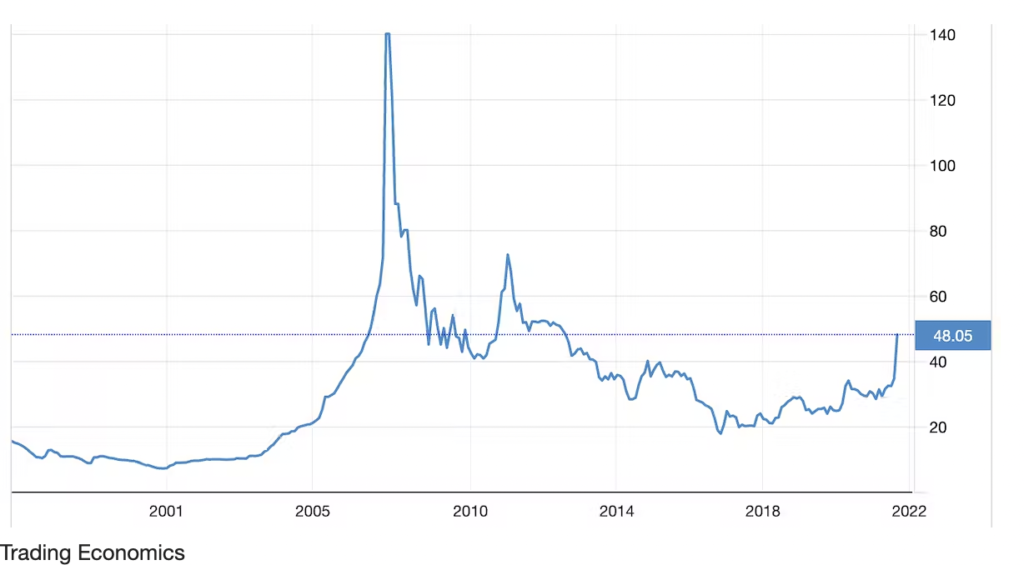

The 1980s marked a period of heightened interest in nuclear power as countries sought to diversify their energy sources. During this era, uranium mining experienced a boom as demand surged. The United States, Canada, and Australia emerged as leading producers. The price of uranium rose steadily during this time, peaking in 1980 at around $50 per pound of U3O8. However, following the Chernobyl disaster in 1986, the industry faced significant setbacks due to safety concerns and public skepticism.

Between 2001 and 2006, the price of uranium saw a downward trend. Factors such as the end of the Cold War, reduced nuclear power plant construction, and increased supplies from decommissioned nuclear weapons contributed to the decline. Prices dropped to a historic low of around $10 per pound in 2001. As a result, many uranium mining operations were forced to curtail production or shut down entirely.

Resurgence and Expansion

The early 2000s marked a turning point for the uranium market. The growing concerns about climate change and the need for clean energy sources rejuvenated interest in nuclear power. Developing nations, particularly China and India, embarked on ambitious nuclear energy programs, leading to a surge in demand. Consequently, the price of uranium skyrocketed, peaking at around $140 per pound in 2007.

The industry witnessed renewed exploration activities and mine expansions to meet the demand.

Global Economic Downturn

2012-2016 The aftermath of the 2008 global financial crisis had a substantial impact on the uranium market. The economic downturn, coupled with the Fukushima nuclear disaster in 2011, dampened prospects for nuclear power expansion. Japan, one of the largest consumers of uranium, temporarily shut down its reactors, leading to an oversupply situation. As a result, the price of uranium plunged to approximately $30 per pound in 2014.

The Road to Recovery

2017-2023 In recent years, the uranium market has experienced a slow but steady recovery. Several factors have contributed to this upward trajectory. Countries such as Japan and China have resumed reactor operations, reigniting demand. Additionally, the growing recognition of nuclear power as a reliable, low-carbon energy source amid efforts to combat climate change has boosted the market’s outlook. The price of uranium has gradually risen to approximately $57 per pound in 2023, indicating a positive trend for the industry.

The history of uranium mining and the price fluctuations it has witnessed over the past four decades reflects the dynamic nature of the global energy landscape. From boom periods driven by nuclear power expansion to downturns caused by safety concerns and economic factors, the industry has weathered various challenges.

As the world grapples with the need for sustainable and clean energy sources, the demand for uranium is expected to persist, highlighting its importance in the transition towards a low-carbon future.

Small modular nuclear reactors hold immense potential as a sustainable energy source of the future. Their enhanced safety features, flexibility, and environmental benefits are a attractive option in the quest for decarbonization.

The Promise of Small Modular Nuclear Reactors

SMRs represent a paradigm shift in nuclear power generation. These reactors are smaller in size compared to conventional ones, typically with a capacity of less than 300 megawatts, allowing for modular construction and simplified designs. This modularity offers flexibility in deployment, enabling them to be utilized in various settings, such as remote locations, industrial complexes, or as a complement to renewable energy sources. SMRs also feature passive safety systems, which reduce the risk of accidents and offer enhanced resilience.

Environmental Benefits and Carbon Reduction

One of the most significant advantages of SMRs lies in their potential to contribute to greenhouse gas emissions reduction. Unlike fossil fuel-based power plants, SMRs produce electricity without releasing carbon dioxide or other harmful pollutants into the atmosphere. Their ability to provide consistent and reliable baseload power makes them an ideal complement to intermittent renewable energy sources, aiding in the transition to a low-carbon energy mix,

Technological Advancements and Cost Competitiveness

In recent years, advancements in reactor design, materials, and manufacturing techniques have accelerated the development of SMRs. These innovations have resulted in more efficient and cost-effective designs, making SMRs increasingly competitive in the energy market. The modular construction approach enables shorter construction times, standardized components, and potential cost savings through economies of scale. As more SMR projects are deployed and economies of scale are realized, further cost reductions are anticipated.

Deployment and Global Market Trends

Several countries, including the United States, Canada, China, and Russia, are at the forefront of SMR development and deployment. Each nation has its own unique approach, ranging from government-led initiatives to public-private partne rships. Notably, the United States has made significant strides in advancing SMRs, with the Nuclear Regulatory Commission streamlining the licensing process and providing regulatory support. Additionally, collaborations and international cooperation in research and development are fueling the growth of SMR technology.

Rolls-Royce is contracted to build SMR tech in the UK

Hybrid Energy Systems and Beyond

An emerging trend in the SMR sector is the integration of these reactors with other energy systems. Hybrid energy systems that combine SMRs with renewable energy sources, such as solar and wind, offer the potential for a more resilient and diverse energy grid. SMRs can provide stable power during periods of low renewable energy generation, ensuring a constant and reliable electricity supply. This integration enhances energy security, grid stability, and overall system efficiency.

Governments across the globe are investing in partnerships with the private sector to boost their advancements. As global deployment increases, the cost competitiveness of SMRs is expected to improve further. By embracing these innovative reactors and exploring hybrid energy systems, the world can move closer to a resilient, low-carbon future, meeting the energy demands while addressing the challenges of climate change. Uranium mining and investment is certainly the key ingredient to that future.