Introduction To The Green Hydrogen Sector

The world is moving towards a greener future, and hydrogen is emerging as a key player in the transition towards sustainable energy.

Green hydrogen, produced through the electrolysis of water using renewable energy sources, is gaining momentum as a clean and versatile fuel that can be used in various sectors, including transport, industry, and power generation.

The market for green hydrogen is projected to grow rapidly in the coming years as countries commit to reducing their carbon footprint and achieving net-zero emissions targets.

The global addressable market for green hydrogen is estimated to be worth trillions of dollars by 2050, with major players across industries investing in the development of green hydrogen technologies.

This article will explore the current trends and addressable market of the green hydrogen sector globally and highlight its potential to transform the energy landscape for a more sustainable future.

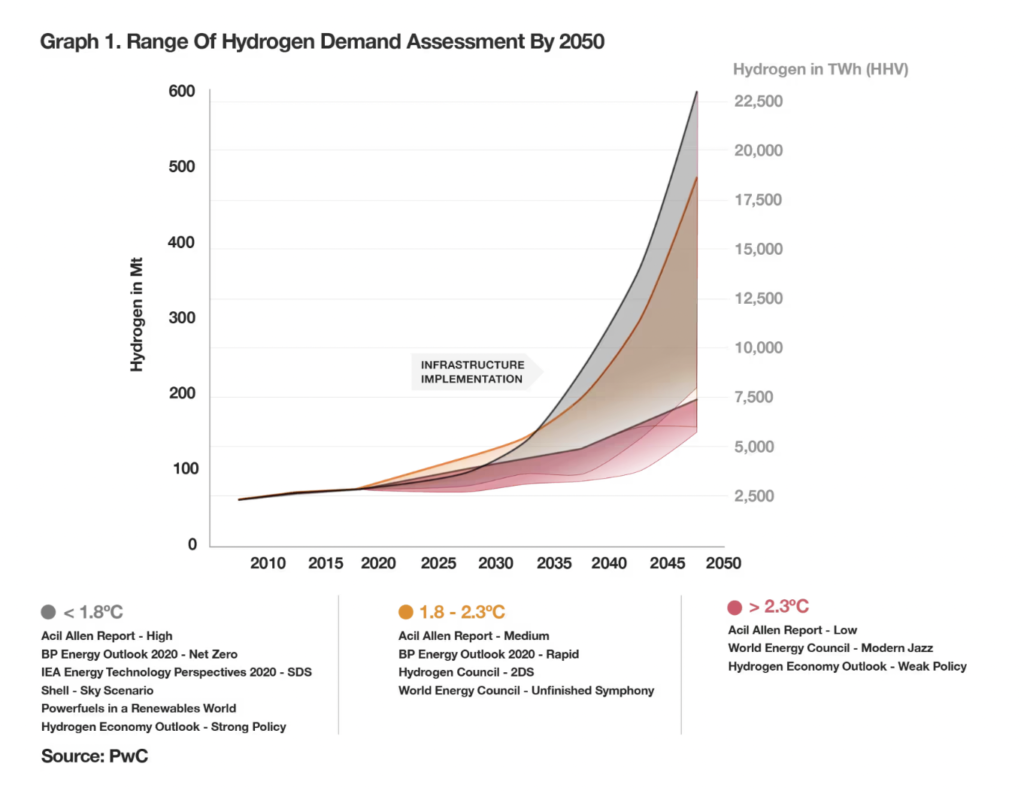

Results from a PWC Analysis on the Future of Green Energy

A recent analysis by PWC concluded the following trends in Green Hydrogen

The key results of our analysis include the following:

Through 2030, hydrogen demand will grow at a moderate, steady pace through many niche applications across the industrial, transport, energy and buildings sectors.

Through cross-sector collaborations, new alliances will form to develop hydrogen projects.

Hydrogen production costs will decrease by around 50% through 2030, and then continue t o fall steadily at a slightly slower rate until 2050.

By 2050, green hydrogen production costs in some parts of the Middle East, Africa, Russia, China, the US and Australia will be in the range of €1 to €1.5/kg.

Over the same time period, production costs in regions with limited renewable resources, such as large parts of Europe, Japan or Korea, will be approximately €2/kg, making these markets likely importers of green hydrogen from elsewhere.

Even regions with good renewable resources but densely populated areas will import hydrogen, as land constraints limit the production of green electricity for direct use and conversion to hydrogen.Many large countries—such as the US, Canada, Russia, China, India and Australia—have regions for both competitive and non-competitive hydrogen production, which could prompt them to develop in-country trading.

Export and import hubs will develop around the world, similar to current oil and gas hubs, but with new players in renewable-rich regions.

Current Addressable Market Of Green Hydrogen Globally

Green hydrogen is fast emerging as a promising energy source globally, and the current addressable market for this eco- friendly fuel is estimated to be worth billions of dollars. According to recent reports, the global green hydrogen market is expected to grow at a CAGR of over 14% between 2020-2025.

In terms of demand, Europe and Asia-Pacific are currently the largest markets for green hydrogen due to their ambitious decarbonization targets.

However, North America is also catching up with several projects in the pipeline, particularly in Canada and the US.

The transportation sector is expected to be one of the biggest beneficiaries of green hydrogen with increased demand for fuel

cell vehicles.

Other sectors such as power generation, industrial processes and heating are also likely to drive demand for

this clean energy source.

Overall, it’s clear that green hydrogen has immense potential and will play a crucial role in transitioning towards a low-

carbon economy globally.

Trends In The Green Hydrogen Sector

The green hydrogen sector is witnessing a surge in demand, driven by the global push towards decarbonization. One of the key trends in the sector is the increasing focus on renewable energy sources for green hydrogen production, such as wind and solar power.

This has led to the development of large-scale projects aimed at producing green hydrogen through electrolysis using renewable energy sources.

Another trend is the growing adoption of fuel cell vehicles, which use green hydrogen as a clean fuel source, particularly in Europe and Asia.

The sector is also witnessing increased investment from governments and private players alike, with several countries announcing ambitious targets for green hydrogen production and usage. Furthermore, collaborations between companies across industries are becoming increasingly common as they work together to develop innovative solutions for efficient and cost-effective production of green hydrogen.

Conclusion And Future Outlook For Green Hydrogen

In conclusion, the green hydrogen sector is poised for significant growth in the coming years. The current addressable market for green hydrogen is expanding rapidly as more countries and companies recognize the need to reduce their carbon footprint.

With increasing investment and technological advancements, the cost of green hydrogen production is expected to decline, making it a viable alternative to fossil fuels.

The trend towards decarbonization and increased adoption of renewable energy sources will continue to drive demand for green hydrogen.

As a result, we can expect an increase in partnerships and collaborations between governments, companies and research institutions to accelerate innovation and development in this field.

However, challenges such as infrastructure limitations and high capital costs remain significant barriers that must be overcome for widespread adoption of green hydrogen technology.

Nonetheless, with commitment from stakeholders across different industries, the future outlook for green hydrogen looks promising as an essential component of a sustainable energy mix.

For investors considering investing in green hydrogen, it’s important to weigh the potential benefits against these challenges and assess the long-term prospects of this emerging market.

Investment Opportunities In Green Hydrogen

Green hydrogen is rapidly gaining popularity as a potential solution to decarbonize the energy sector. This renewable energy source is produced by electrolyzing water using renewable electricity, and it has the potential to replace fossil fuels across various industries.

As governments around the world are increasing their focus on reducing carbon emissions, investors are starting to see green hydrogen as a promising investment opportunity.

The market for green hydrogen is expected to grow exponentially over the next decade, reaching $11 trillion by 2050. Investors can take advantage of this growth by investing in companies involved in green hydrogen production, transportation and storage.

Companies like Plug Power, ITM Power, and Ballard Power Systems have already made significant strides in the industry and are poised for future growth.

In addition, government incentives and subsidies for green energy provide further opportunities for investors looking to capitalize on this emerging market.

Potential Risks For Investors

While green hydrogen presents a promising investment opportunity, there are also potential risks that investors should consider.

Firstly, the technology is still in its early stages and may not be commercially viable for some time. This means that investors may have to wait several years before seeing a return on their investment.

Additionally, there is currently limited infrastructure in place to support the widespread adoption of green hydrogen.This could result in higher costs for production and distribution, which could ultimately impact profitability.

There is also the risk of competition from other renewable energy sources such as solar and wind power which may prove more cost-effective in certain regions or industries.

Finally, regulatory changes or government policies could impact investor returns if subsidies or incentives are reduced or eliminated.

Overall, while green hydrogen has potential as an investment opportunity, it is important for investors to carefully assess the risks before making any decisions.

List Of Green Hydrogen Stocks And Funds Globally

Green hydrogen is a rapidly growing sector in the renewable energy industry, and investors are keen to capitalize on its potential. As a result, many companies and funds around the world are emerging as key players in this space.

Gren Hydrogen Stock and ETFs:

The list of green hydrogen stocks and funds globally includes established players like Siemens Energy, Nel ASA, Plug Power Inc., Fortescue Metals/FFI, FuelCell Energy Inc., and ITM Power Plc.

These companies are already involved in various aspects of the green hydrogen value chain, including production, transportation, storage, and fuel cells.

There are also several green hydrogen-focused funds that have emerged to invest specifically in this sector.

Some of these include First Trust Global Wind Energy ETF (FAN), iShares Global Clean Energy ETF (ICLN), Invesco WilderHill Clean Energy ETF (PBW), and VanEck Vectors Low Carbon Energy ETF (SMOG).

Investment Opportunities In The Green Hydrogen Market

Investment opportunities in the green hydrogen market are expanding rapidly as governments worldwide commit to reaching net- zero emissions targets.

Green hydrogen is produced by using renewable energy to split water into hydrogen and oxygen, making it a sustainable alternative to fossil fuels.

The demand for green hydrogen is expected to grow exponentially in the coming years, creating significant investment opportunities for those looking to contribute to a more sustainable future.

Investors can explore different options such as buying stocks of companies involved in the production or distribution of green hydrogen, investing in exchange-traded funds (ETFs) that focus on clean energy, or participating in private equity funds specializing in renewable energy projects.

It’s important to note that investing in green hydrogen comes with risks and requires careful consideration. Investors should evaluate each opportunity based on factors such as market potential, regulatory environment, and financial stability.

Is Green Hydrogen A Worthwhile Investment?

Green hydrogen has the potential to be a worthwhile investment for those willing to wait for the industry to mature.

While there are still challenges to be addressed such as high production costs and limited infrastructure, the demand for renewable energy and decarbonization efforts will likely drive demand for green hydrogen in the long term.

Investors who choose to invest in green hydrogen should carefully consider companies with a strong track record of innovation and sustainability, as well as those with established partnerships and government support. It is also important to recognize that investing in green hydrogen may not yield immediate returns, but rather require patience and a long-term perspective.

Overall, while there are risks associated with investing in any emerging industry, green hydrogen presents an opportunity for investors to align their portfolios with sustainability goals while potentially benefiting financially in the future.