The Humble Beginnings Of Pilbara Minerals

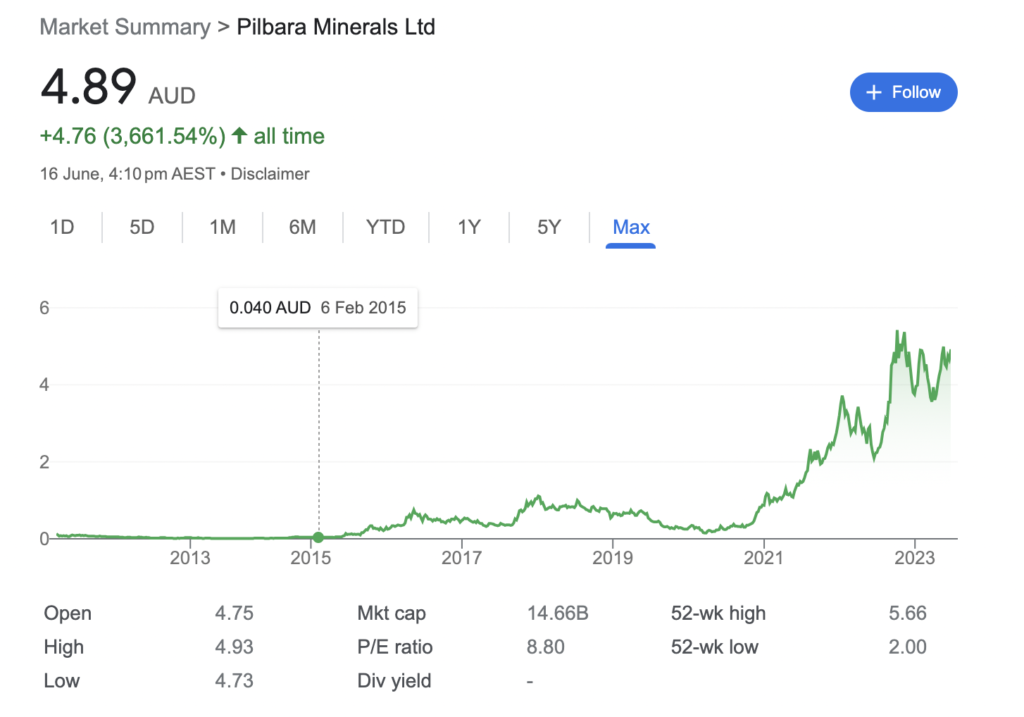

Pilbara Minerals, an Australian lithium and tantalum miner, has come a long way in just a few short years and made many small time investors millionaires many times over.

(A $30,000 investment in ASX:PLS in 2015 would now be worth $4 million),=.

The company was founded in 2005 with just two employees and a market cap hovering around A$2 million.

It started as a junior exploration company in the Pilbara region of Western Australia, searching for minerals such as iron ore and manganese. However, after discovering lithium deposits in 2010, the company shifted its focus towards developing these resources.

Pilbara Minerals’ fortunes changed dramatically with the rise of electric vehicles across the world and battery storage systems for sustainable renewable energy. Lithium, a key component in these technologies, is leading to increased demand for the metal and driving up prices.

In response to this trend, Pilbara Minerals invested heavily in developing its lithium resources and built a processing plant capable of producing 2 million tonnes per annum.

Today, Pilbara Minerals is valued at nearly $15 billion and employs over 600 people across Australia.

A meteoric rise for shareholders.

The rise of lithium and battery metals has been nothing short of remarkable in recent years, with the global demand for these minerals skyrocketing due to the increasing popularity of electric vehicles and renewable energy storage solutions.

Pilbara Minerals ASX is a prime example of a company that has benefited greatly from this trend, with its market cap increasing from $2 million to nearly $15 billion thanks to its involvement in the lithium and battery metals boom.

The Australian mining company has focused on developing its Pilgangoora Lithium-Tantalum Project in Western Australia, which is one of the largest lithium ore deposits in the world. As more and more countries aim to reduce their carbon footprints by transitioning to cleaner forms of energy, it’s likely that demand for lithium and other battery metals will only continue to grow.

Pilbara Minerals’ Meteoric Growth

Pilbara Minerals’ meteoric growth in the past few years can be attributed to the lithium and battery metals boom. The company, which had a market cap of just $2 million in 2015, has now grown to nearly $15 billion.

This growth has been fueled by the increasing demand for lithium-ion batteries, which are used in electric vehicles and other electronic devices.

Pilbara Minerals’ flagship project, the Pilgangoora Lithium-Tantalum Project, is one of the largest lithium ore deposits in the world.

With a production capacity of 330,000 tons per annum, it is expected to become a major contributor to global lithium supply. The company’s success has also been due to its partnerships with major players in the electric vehicle industry such as Tesla and South Korea’s POSCO.

Pilbara Minerals’ rapid rise shows how quickly fortunes can change in an industry that is constantly evolving.

What The Future Holds For Pilbara Minerals

As Pilbara Minerals continues to ride the wave of the lithium and battery metals boom, many investors are wondering what the future holds for this once-small company.

With a market cap of nearly $15 billion, the company has seen explosive growth in just a few short years. However, some analysts are cautioning that this rapid expansion may not be sustainable in the long term.

As more players enter the market and competition heats up, Pilbara Minerals will need to stay ahead of the curve if it hopes to maintain its position as a top player in the industry. This may involve expanding into new markets or diversifying its product offerings beyond lithium and battery metals. Whatever path it chooses, one thing is certain: Pilbara Minerals will continue to be a major player in the global energy landscape for years to come.